BlackRock Is Pulling Bitcoin Whales Into Wall St’s Orbit

PositiveFinancial Markets

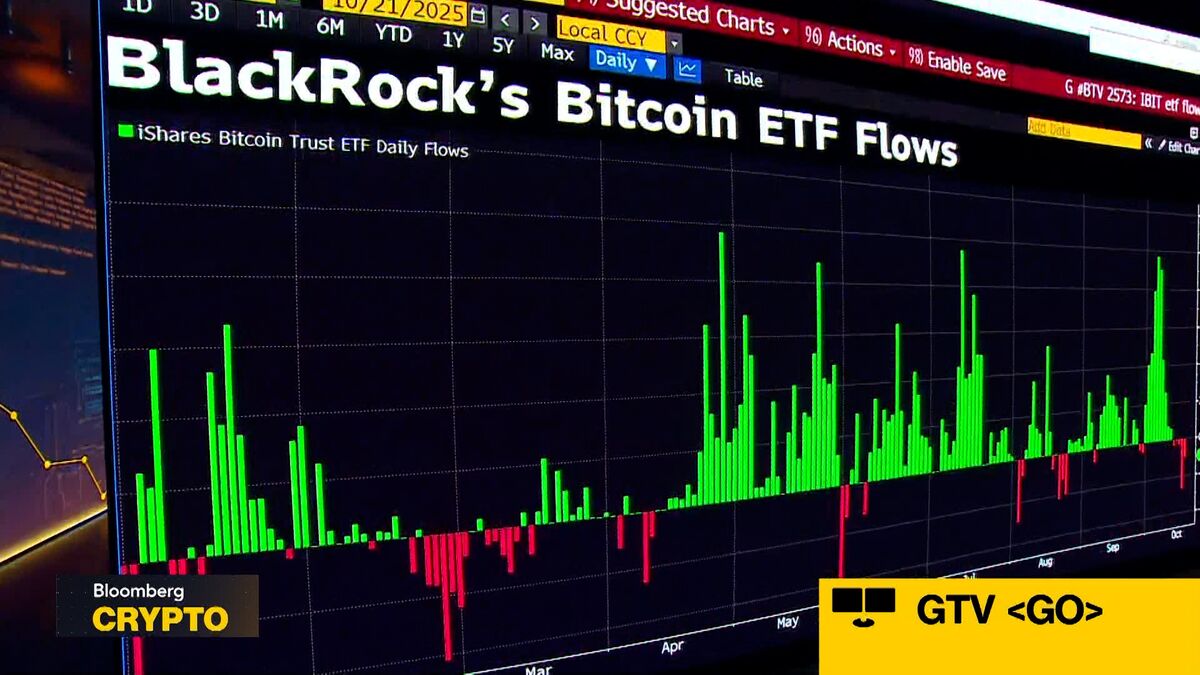

Big Bitcoin holders are now able to transition their wealth from the blockchain to Wall Street, thanks to a new wave of ETFs. This development allows crypto investors to integrate their digital assets into the regulated financial system without having to sell, all facilitated by major asset managers like BlackRock. This is significant as it represents a growing acceptance of cryptocurrency in traditional finance, potentially leading to increased stability and legitimacy for the crypto market.

— Curated by the World Pulse Now AI Editorial System