Wall Street selloff raises worries about market downturn

NegativeFinancial Markets

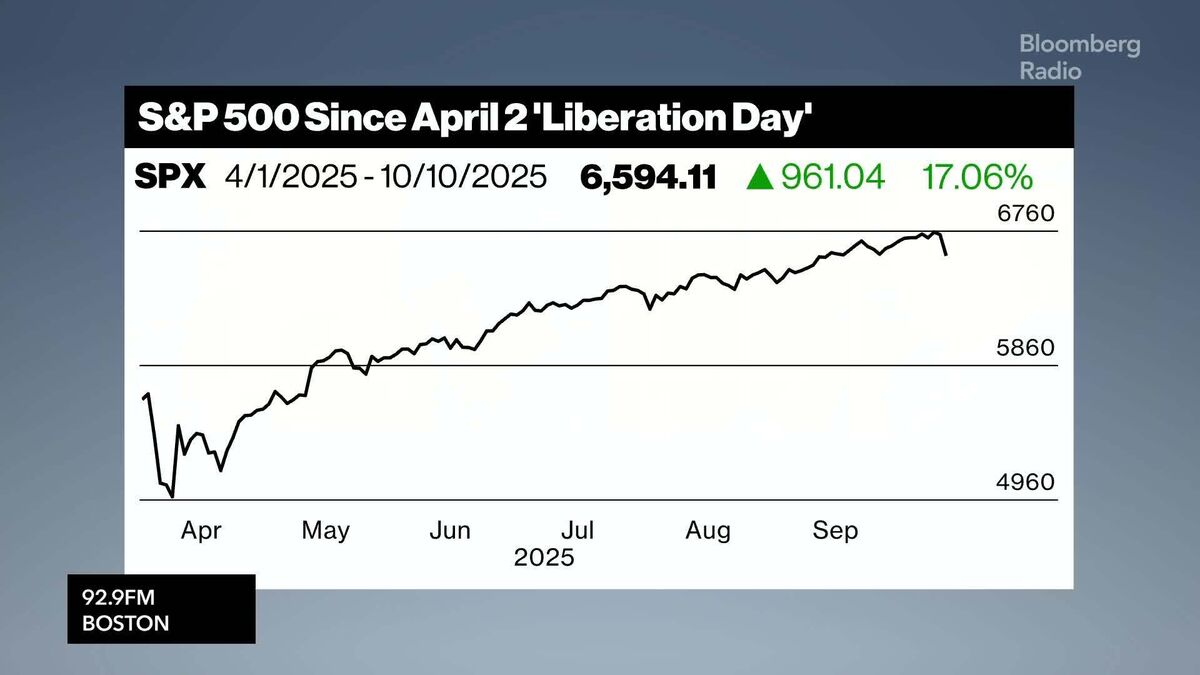

The recent selloff on Wall Street has raised significant concerns among investors about a potential market downturn. As stocks plummet, many are questioning the stability of the economy and the factors driving this decline. This situation matters because it could impact investment strategies and consumer confidence, leading to broader economic implications.

— Curated by the World Pulse Now AI Editorial System