Saudi Small Caps Set to Test IPO Market Amid Valuation Scrutiny

NeutralFinancial Markets

Saudi Small Caps Set to Test IPO Market Amid Valuation Scrutiny

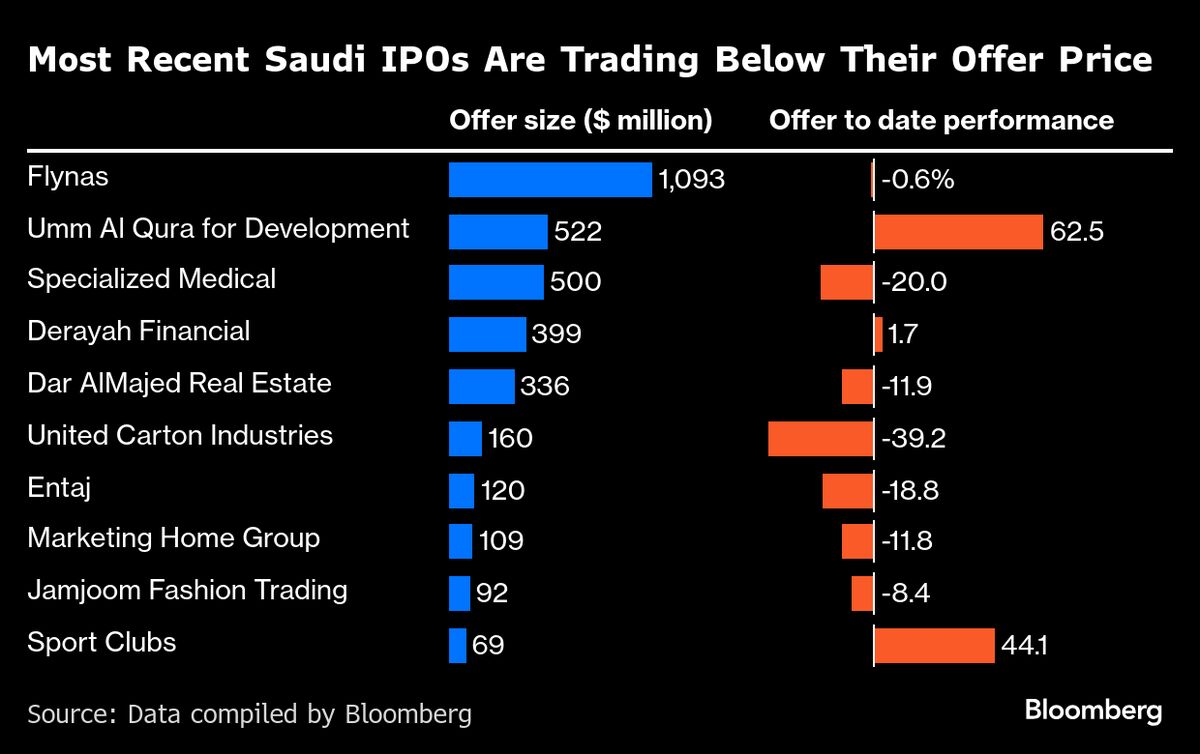

A group of smaller companies in Saudi Arabia is preparing to enter the IPO market, despite the current challenges in the equity market. Their success will largely depend on how well they manage their pricing strategies, as investors are becoming more discerning in their choices. This situation highlights the ongoing evolution of the market and the importance of careful valuation in attracting investment.

— via World Pulse Now AI Editorial System