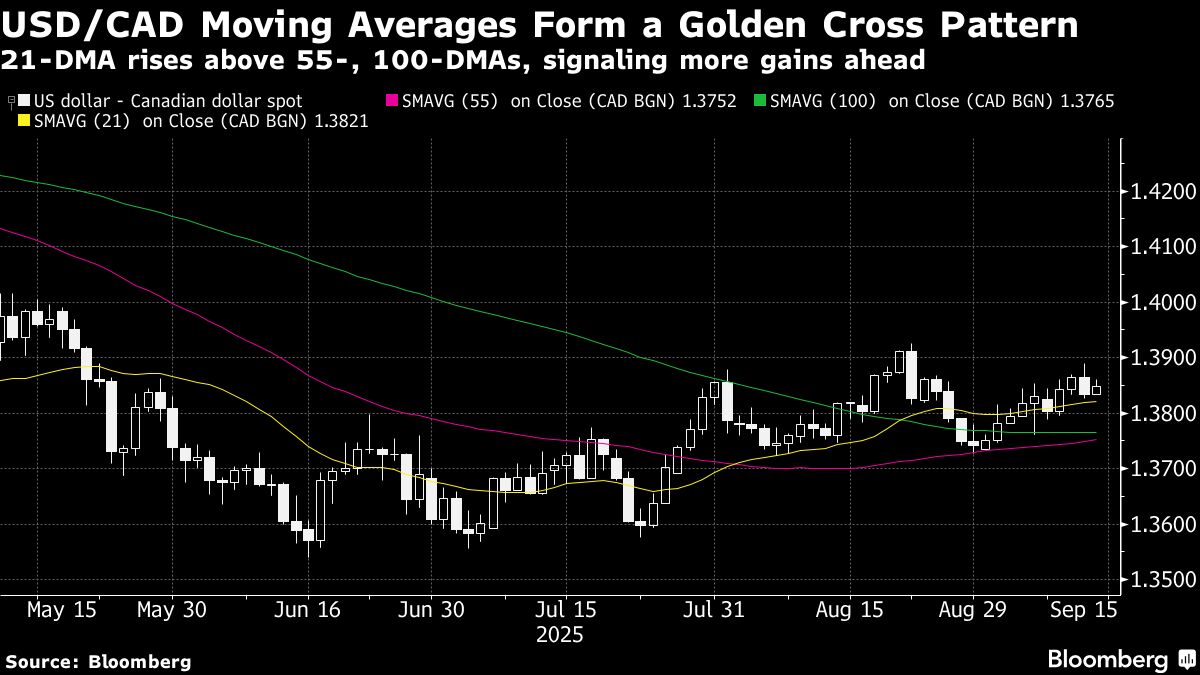

Loonie Set for Rebound as Fed Cuts and Canada Slows Easing Cycle

PositiveFinancial Markets

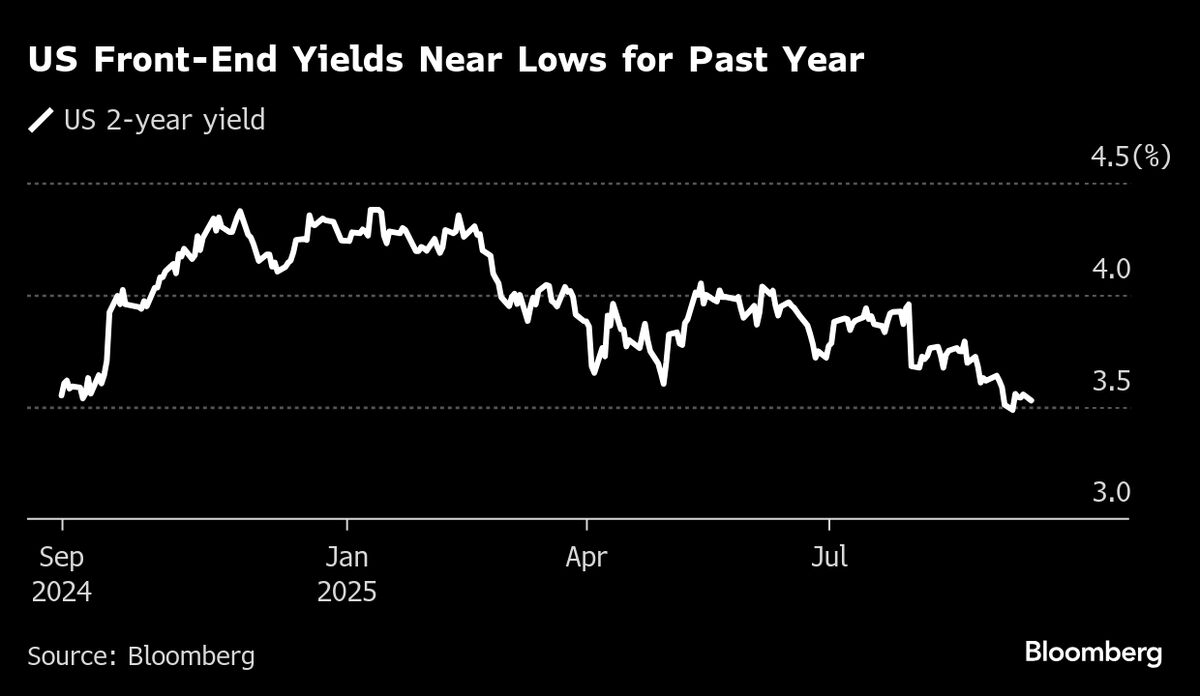

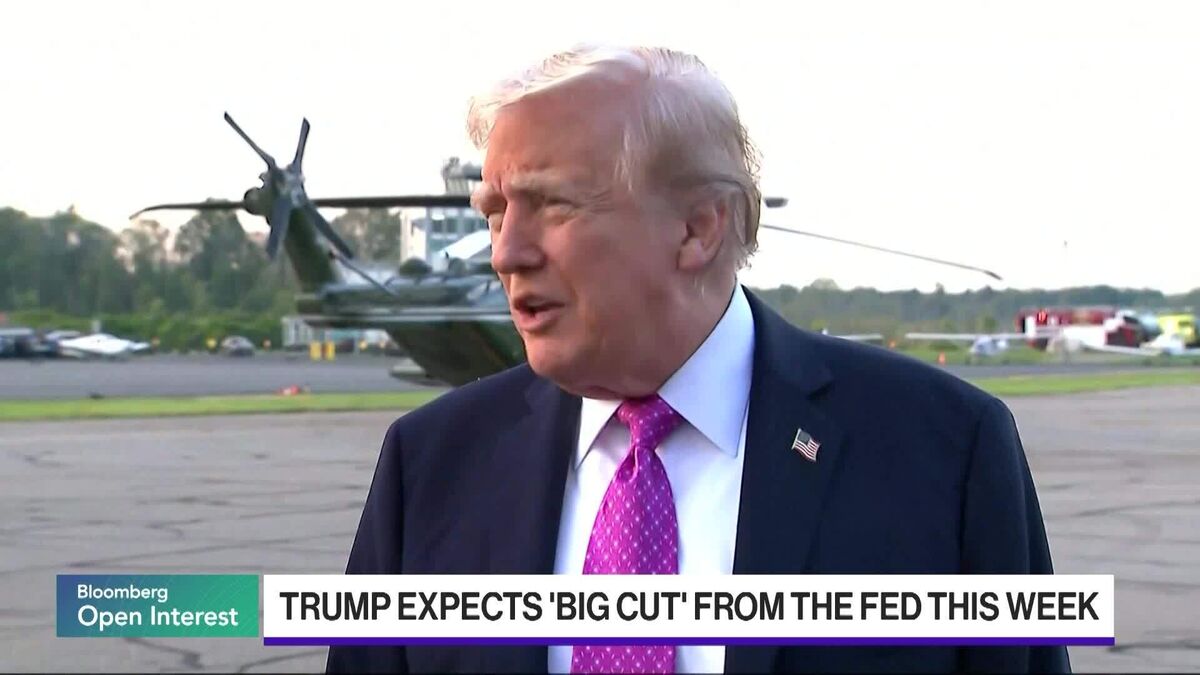

Canada's currency, the loonie, is expected to strengthen as the Bank of Canada approaches the end of its easing cycle while the Federal Reserve prepares for interest rate cuts.

Editor’s Note: This development is significant as it indicates a potential stabilization of the Canadian economy and could lead to a more favorable exchange rate for the loonie against the US dollar, benefiting trade and investment.

— Curated by the World Pulse Now AI Editorial System