Not All Tariffs Costs Have Passed Through: JPM's Feroli

NeutralFinancial Markets

- Michael Feroli, chief US economist at JPMorgan Securities, expressed that the upcoming decision on a December rate cut is uncertain, with lingering tariff

- This situation is critical for the Federal Reserve as it navigates monetary policy, aiming to balance inflation control with economic growth.

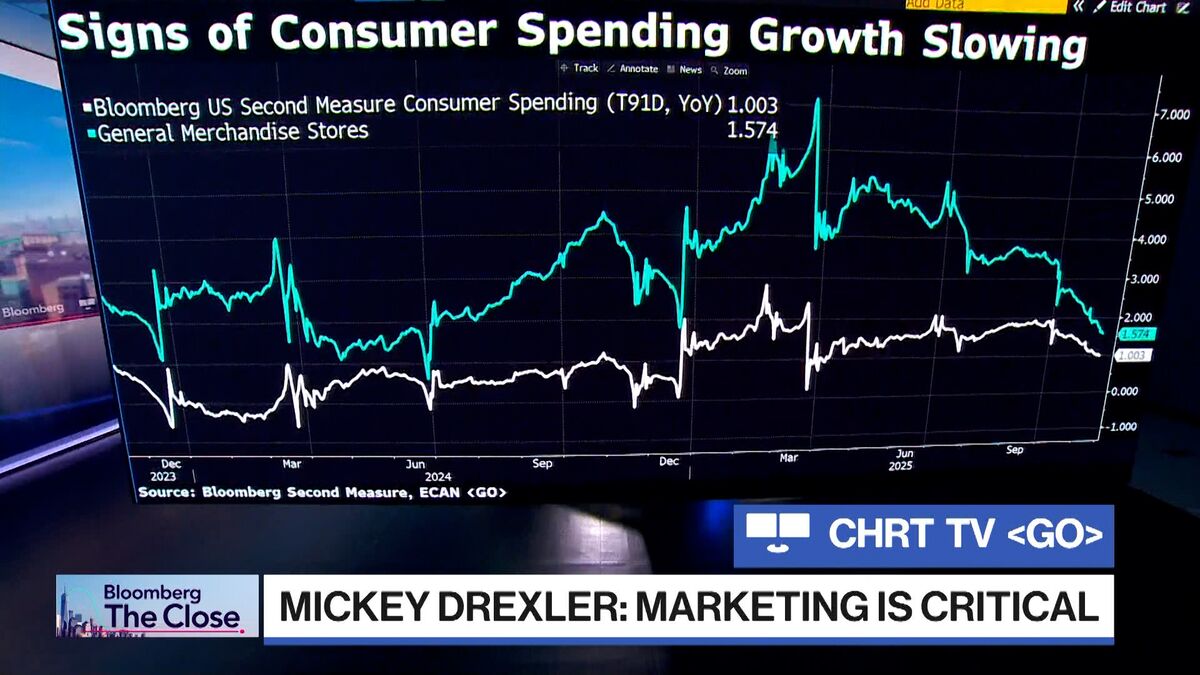

- The broader economic landscape shows mixed signals, with consumer spending trends indicating a decrease in holiday budgets, raising concerns about overall economic health and the effectiveness of previous tariff implementations.

— via World Pulse Now AI Editorial System