Tech shares fall over AI bubble fears

NegativeFinancial Markets

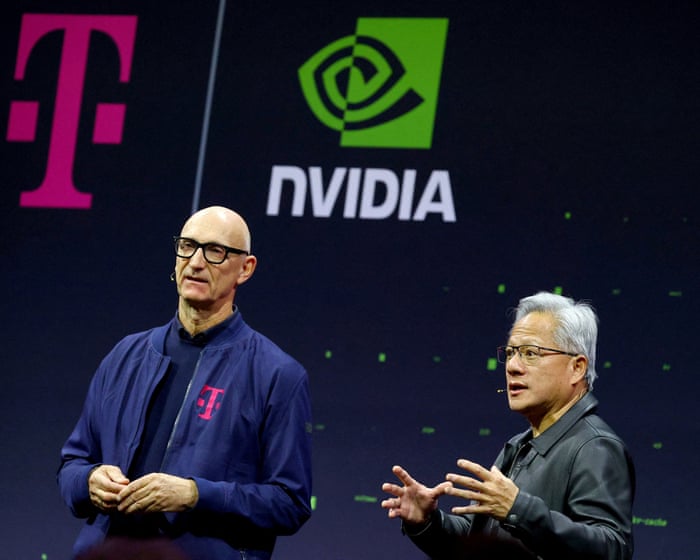

Shares of major tech companies in the US and Japan have recently declined due to growing concerns about inflated valuations in the AI sector. This downturn highlights the volatility in tech markets and raises questions about the sustainability of AI investments, which could impact future innovation and economic growth.

— Curated by the World Pulse Now AI Editorial System