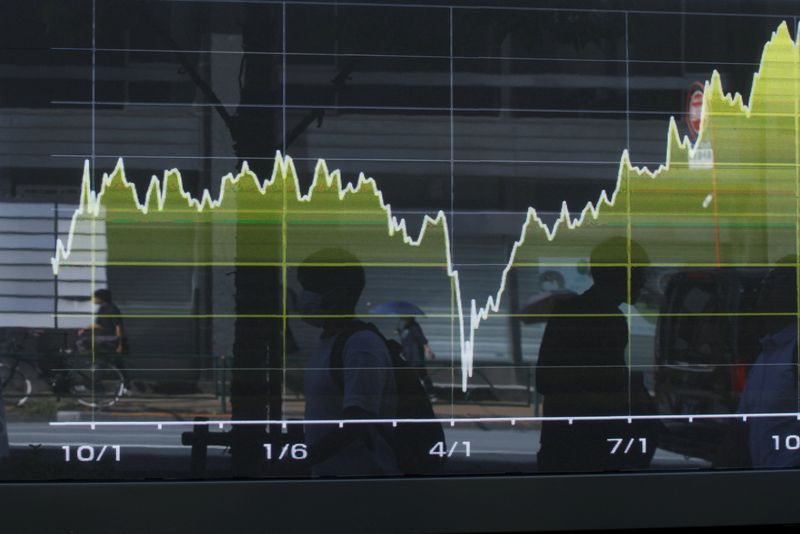

US stocks steady as investors shrug off banking jitters

PositiveFinancial Markets

US stocks have shown resilience as investors remain optimistic, even in the face of recent banking concerns. The market's recovery was bolstered by Donald Trump's comments suggesting that proposed heightened tariffs on Chinese imports might not be permanent. This development is significant as it reflects investor confidence and a potential easing of trade tensions, which could lead to a more stable economic environment.

— Curated by the World Pulse Now AI Editorial System