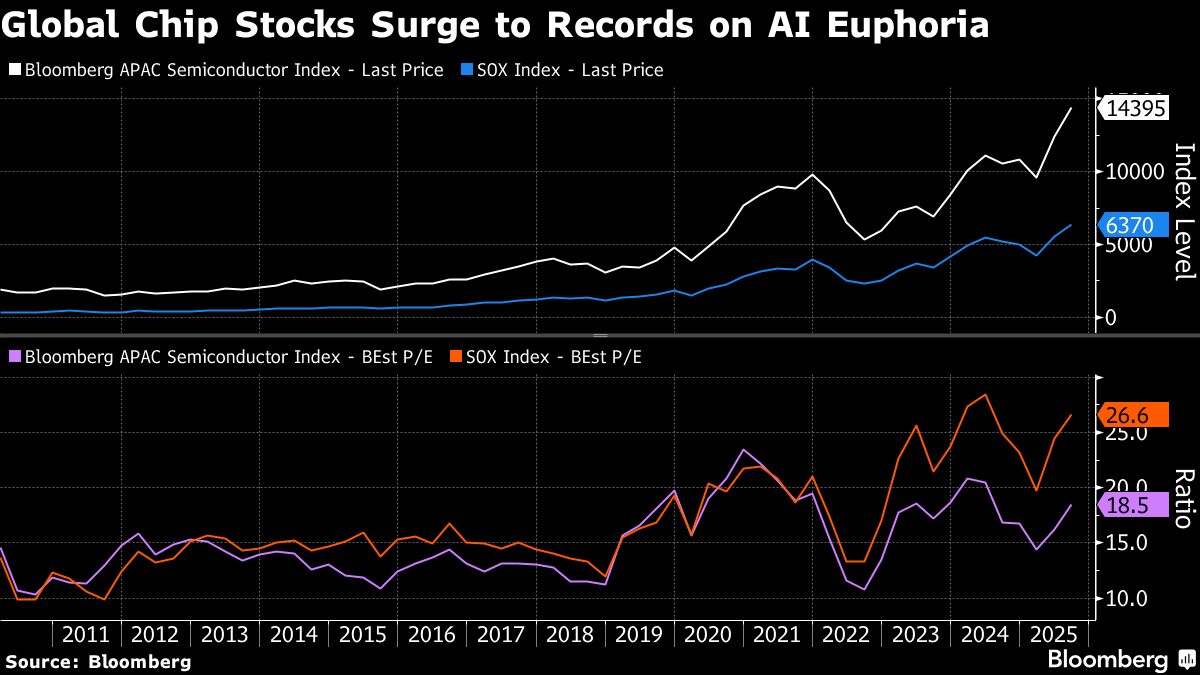

Global Chipmakers Add $200 Billion in Record Rally on AI Frenzy

PositiveFinancial Markets

Global chipmakers have experienced a remarkable surge in market value, adding $200 billion as investors flock to capitalize on the artificial intelligence boom. This rally highlights the growing confidence in tech stocks, which are reaching unprecedented heights. The excitement around AI is not just a trend; it signifies a transformative shift in technology that could reshape industries and drive future innovations.

— via World Pulse Now AI Editorial System