S&P Dips After Trump Comments | Closing Bell

NegativeFinancial Markets

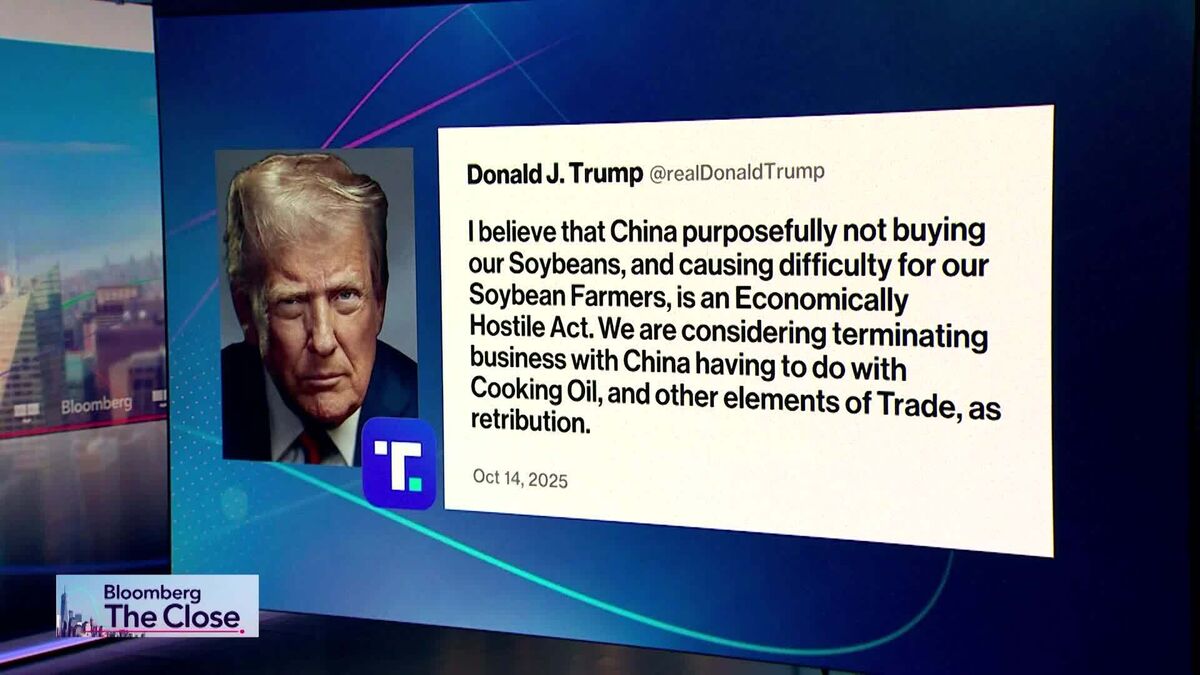

The U.S. stock market experienced a dip following comments made by former President Trump, highlighting the ongoing volatility in the financial landscape. This matters because market reactions to political statements can significantly influence investor confidence and economic stability.

— Curated by the World Pulse Now AI Editorial System