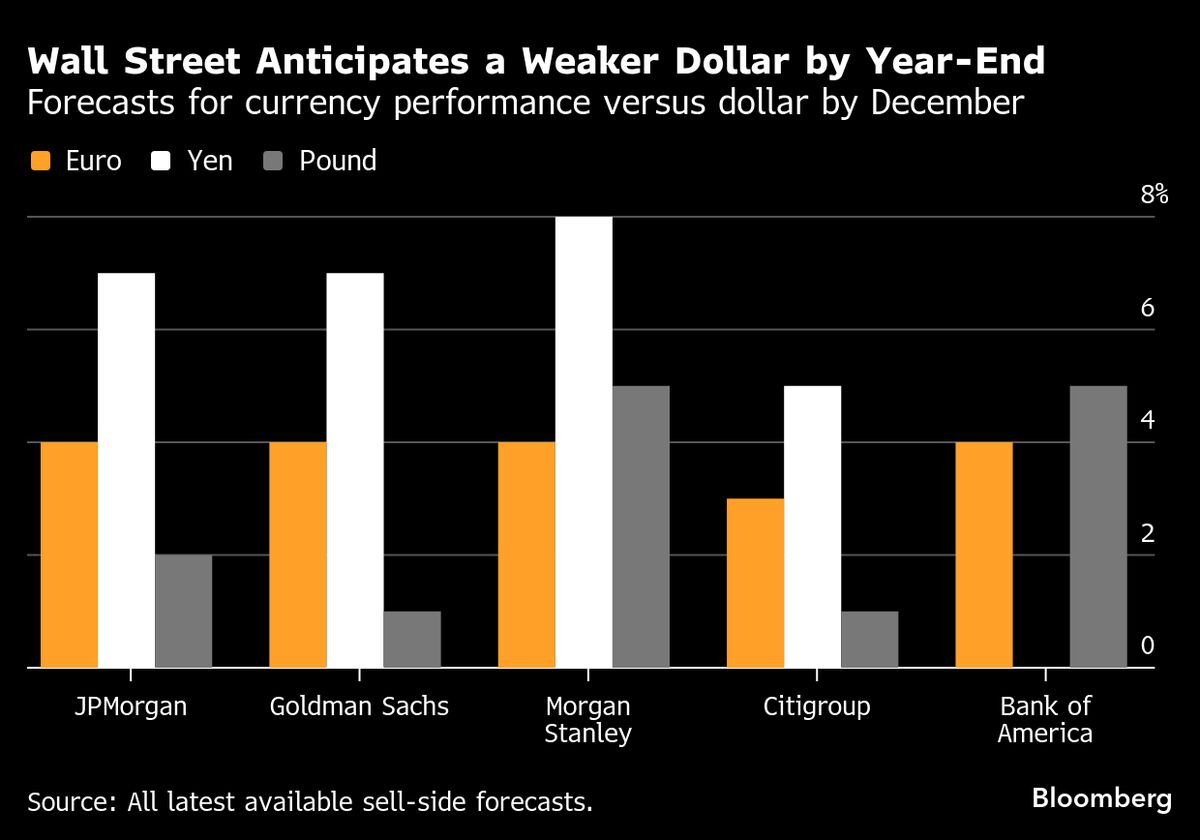

The Big Dollar Short Is Turning Into a Pain Trade for Investors

NegativeFinancial Markets

This year, betting against the dollar has been a popular strategy in the massive $9.6 trillion-a-day foreign exchange market. However, recent trends indicate that this trade is beginning to falter, causing concern among investors. Understanding the shifts in currency value is crucial, as it can significantly impact global markets and investment strategies.

— via World Pulse Now AI Editorial System