Canada to boost Indonesia exports to diversify non-US trade, says minister

PositiveFinancial Markets

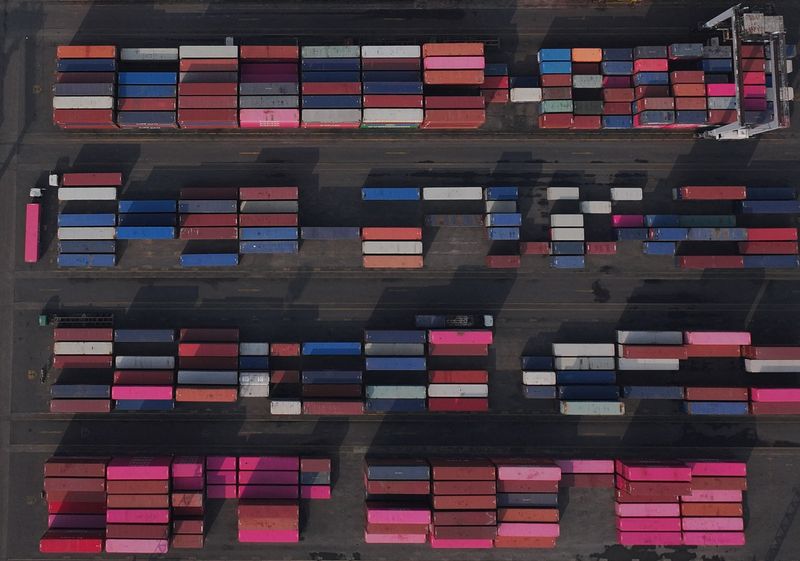

Canada is taking significant steps to enhance its trade relationship with Indonesia, aiming to diversify its exports beyond the United States. This initiative, announced by a Canadian minister, highlights the importance of expanding trade partnerships in a global economy that is increasingly interconnected. By boosting exports to Indonesia, Canada not only strengthens its economic ties but also opens up new markets for its goods, which is crucial for long-term growth and stability.

— Curated by the World Pulse Now AI Editorial System