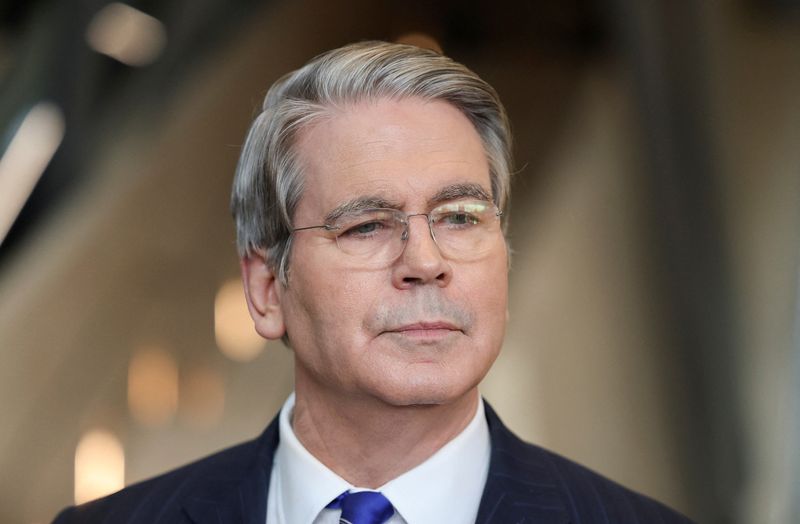

$100bn stock swings expose ‘fragility’ beneath Wall Street rally

NegativeFinancial Markets

Recent fluctuations in the stock market, with swings totaling $100 billion, highlight the underlying fragility of the Wall Street rally. The surge in options and ETF trading has increased volatility among major US stocks, raising concerns as investors brace for upcoming earnings reports from Big Tech companies. This situation is significant as it reflects the precarious balance in the market and could impact investor confidence moving forward.

— Curated by the World Pulse Now AI Editorial System