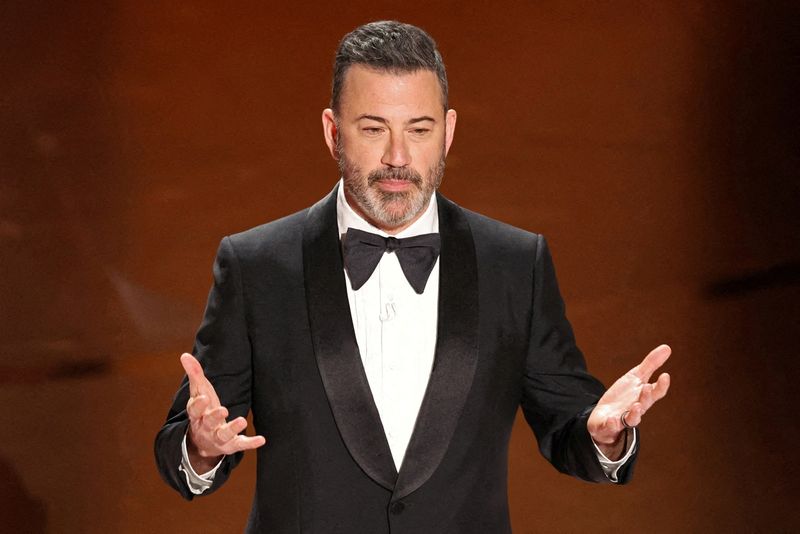

Disney investors seek clarity on Kimmel’s suspension

NeutralFinancial Markets

Disney investors are looking for clarity regarding the recent suspension of Jimmy Kimmel. This situation is significant as it raises questions about the company's management decisions and their impact on programming and audience engagement. Investors are keen to understand the reasons behind the suspension and how it might affect Disney's brand and financial performance.

— Curated by the World Pulse Now AI Editorial System