Trump, Xi to Hold Call; FedEx Sees Sales Growth Amid $1B Tariff Hit | Bloomberg Brief 9/19/2025

NeutralFinancial Markets

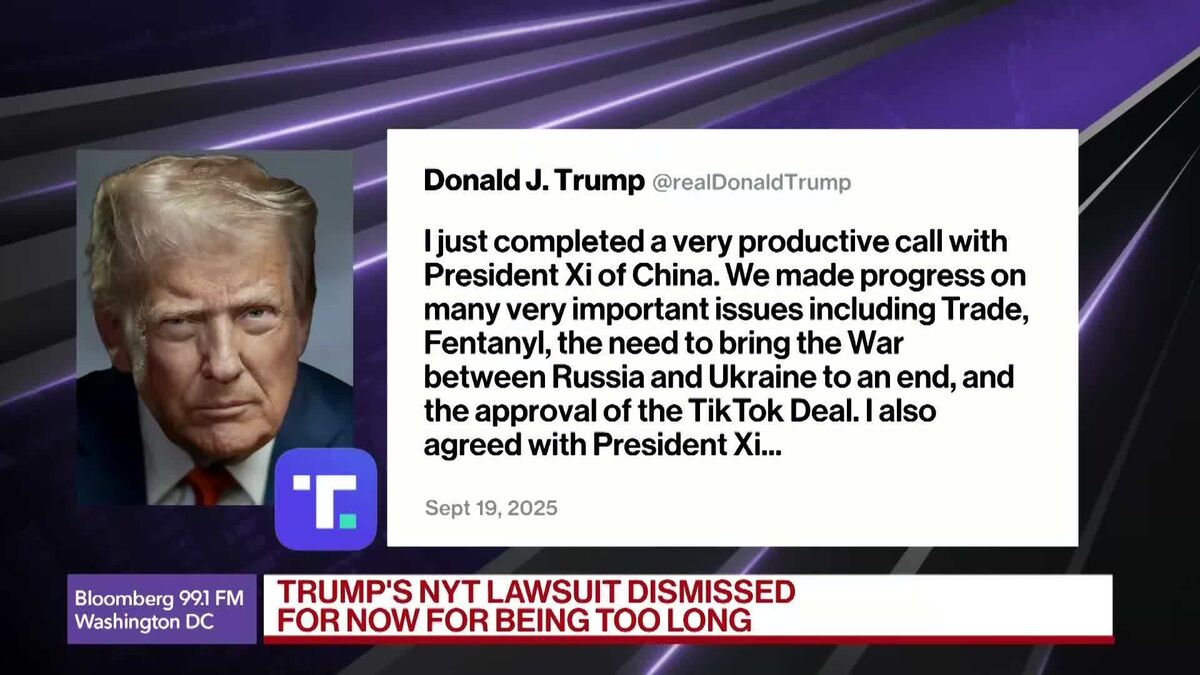

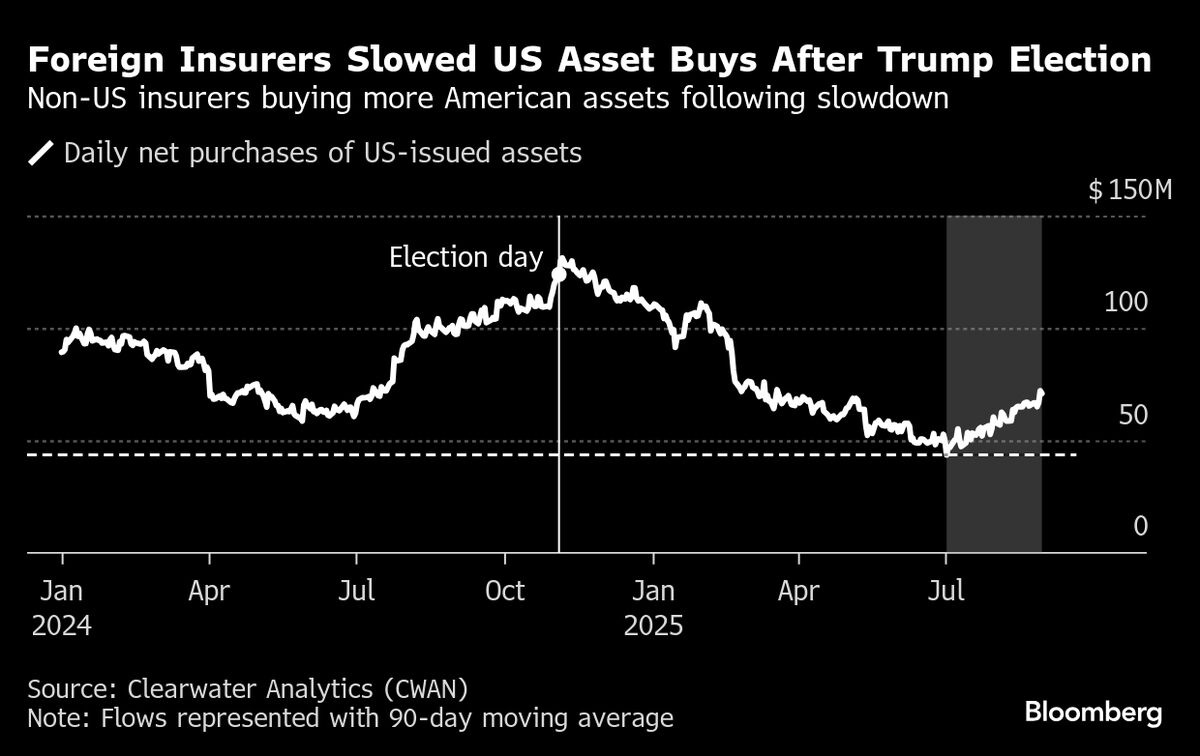

In a significant development, Presidents Donald Trump and Xi Jinping are set to hold a call to address key issues such as TikTok, tariffs, and Nvidia chips. This conversation comes at a time when FedEx has reinstated its sales and profit outlook despite facing a $1 billion impact from trade volatility this year. The market is reacting cautiously, with US equity futures showing mixed signals and the dollar gaining strength. This call between the two leaders could influence future trade relations and market stability, making it a crucial moment for investors and businesses alike.

— Curated by the World Pulse Now AI Editorial System