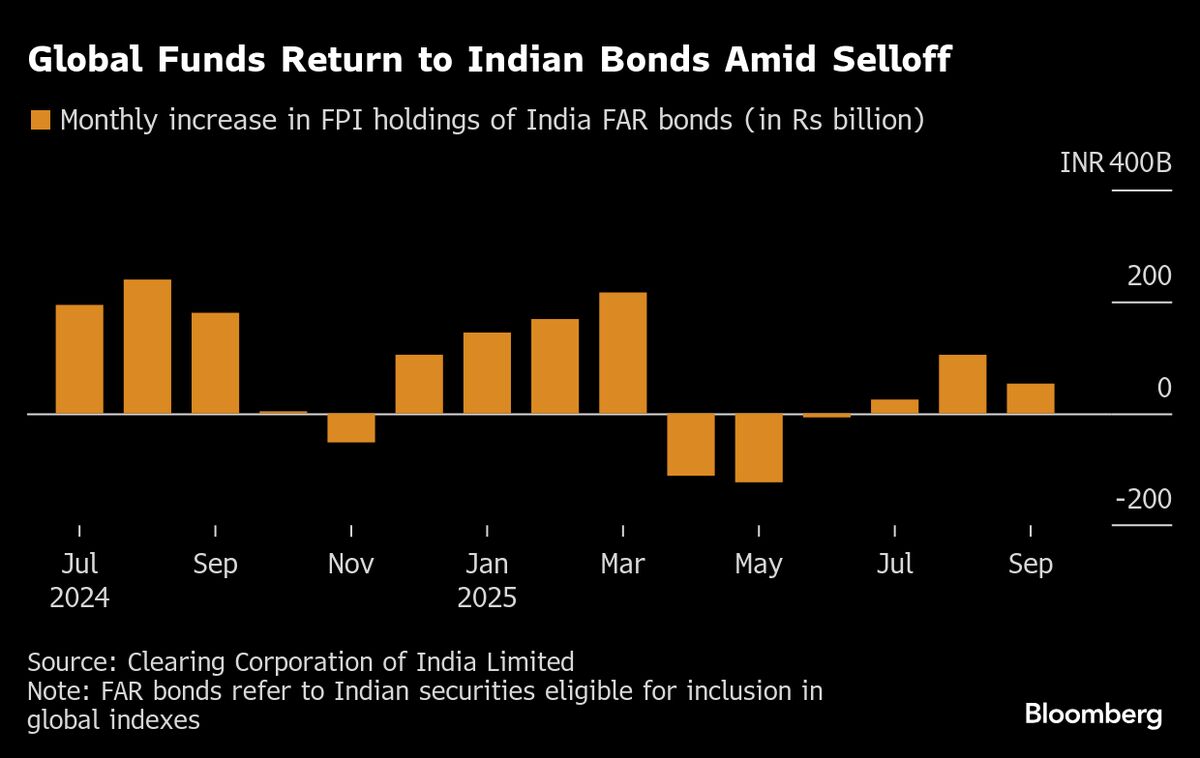

Indian Bonds Ripe for Rally on Foreign Inflows, BlackRock Says

PositiveFinancial Markets

According to BlackRock, Indian bonds are now an appealing option for foreign investors following a significant selloff. This presents a potential rally opportunity, which could attract more capital into the Indian market, benefiting both investors and the economy. It's a promising sign for those looking to diversify their portfolios.

— Curated by the World Pulse Now AI Editorial System