Chinese Savers Have $23 Trillion And Few Options Beyond Stocks

NeutralFinancial Markets

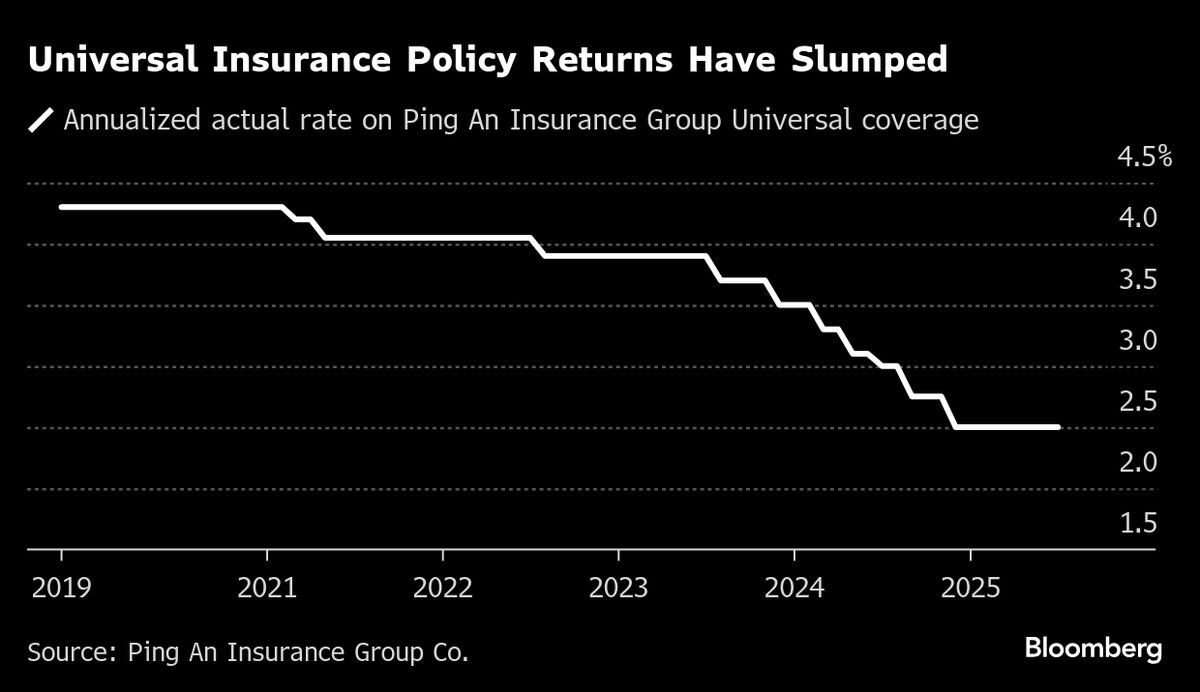

Chinese households are cautiously returning to the stock market, as they face limited investment options. With a staggering $23 trillion in savings, many are finding that equities are one of the few viable choices available. This trend highlights the challenges savers face in a market where alternative investments seem less appealing, making it a significant moment for both investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System