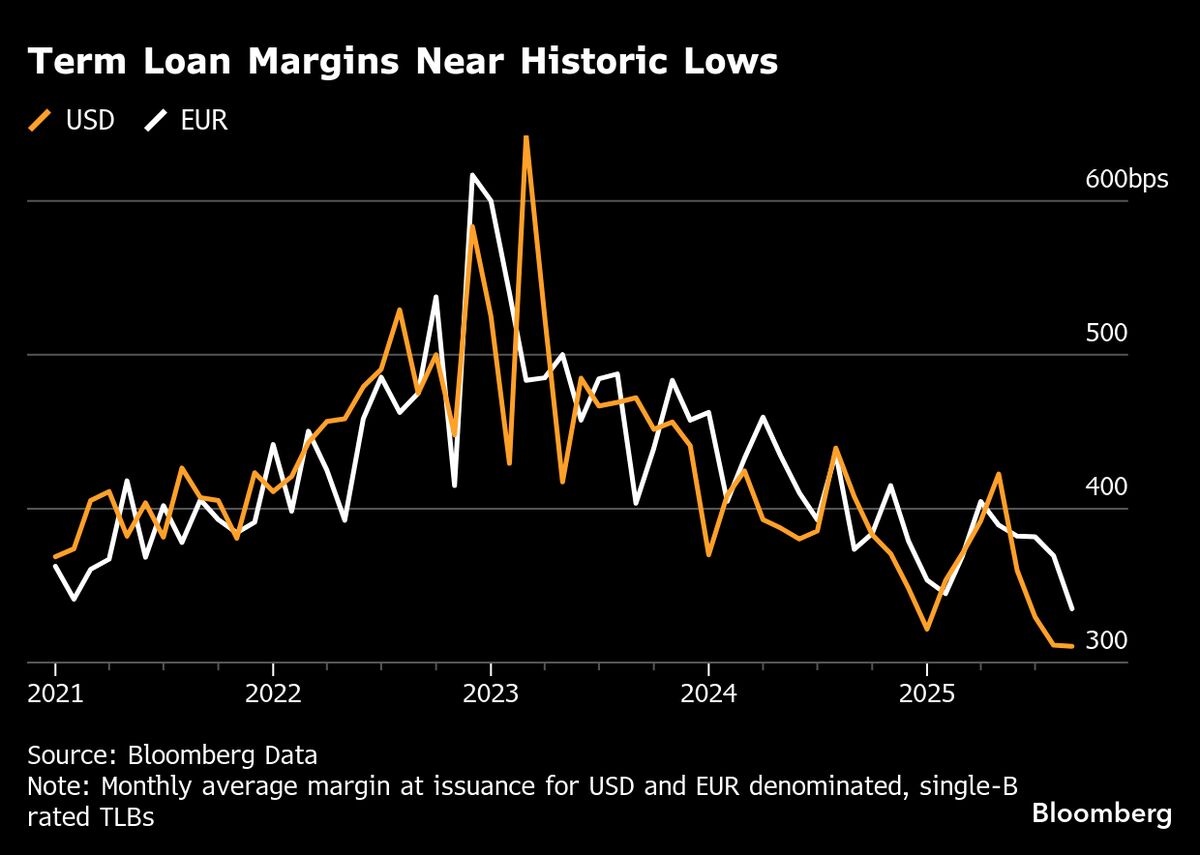

Private Equity Leans on Weaker Credit Safeguards, Moody’s Says

NegativeFinancial Markets

A recent report from Moody's Ratings highlights a troubling trend in credit markets, where private equity-backed borrowers are pushing for riskier loans that lack strong financial safeguards. This shift is concerning because it could lead to significant losses in the event of defaults, impacting investors and the broader economy. Understanding these dynamics is crucial as they may signal a shift in lending practices that could have far-reaching consequences.

— Curated by the World Pulse Now AI Editorial System