Morgan Stanley, MUFG See Dollar Drop Once US Key Data Void Ends

NegativeFinancial Markets

Morgan Stanley, MUFG See Dollar Drop Once US Key Data Void Ends

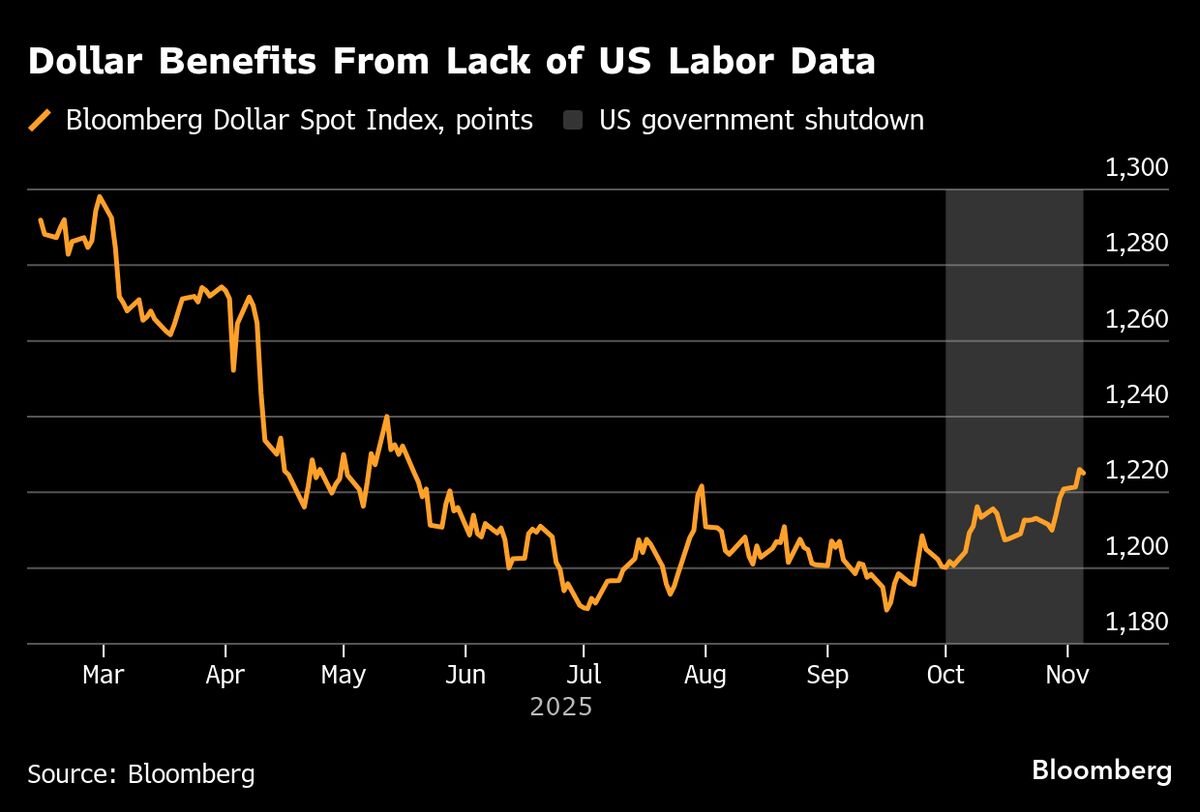

Currency strategists from Morgan Stanley and MUFG are predicting a decline in the US dollar as the government shutdown has masked underlying weaknesses in the labor market. Once key economic data resumes, they believe these vulnerabilities will become apparent, leading to a drop in the dollar's value. This matters because it could impact global markets and trade dynamics, affecting everything from import prices to investment strategies.

— via World Pulse Now AI Editorial System