Historic Silver Squeeze Deepens as Prices Soar in London Market

PositiveFinancial Markets

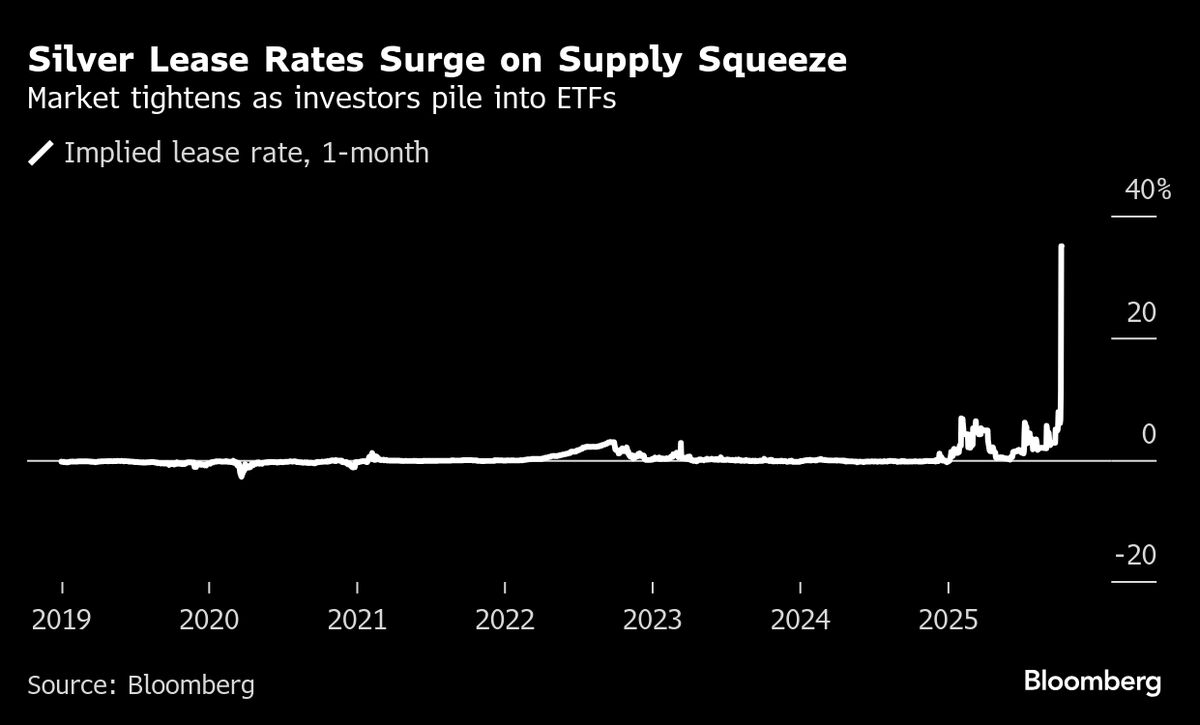

Silver prices are soaring towards all-time highs, surpassing $50 an ounce, as a historic squeeze intensifies in the London market. This surge is significant as it reflects growing demand and market dynamics that could reshape investment strategies and economic forecasts.

— Curated by the World Pulse Now AI Editorial System