Singapore’s GIC Seeks to Sell $1 Billion of Stakes in PE Funds

NeutralFinancial Markets

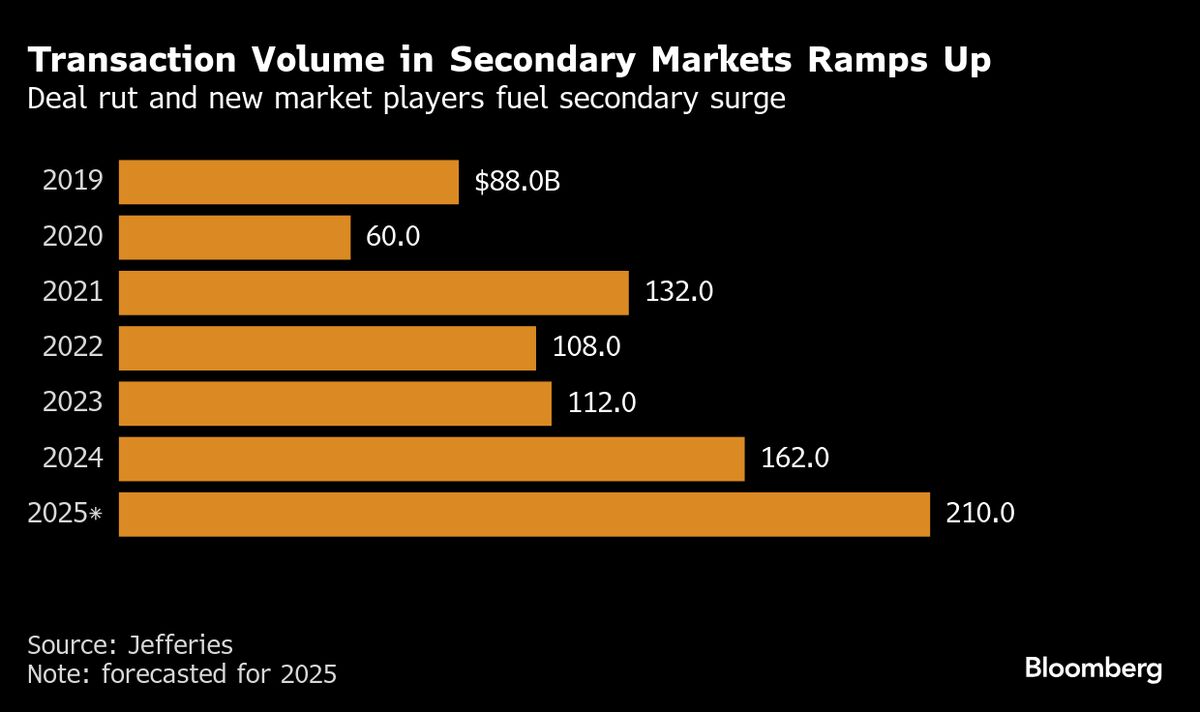

Singapore's GIC Pte is planning to sell $1 billion worth of stakes in private equity funds, leveraging the thriving secondaries market to optimize its investment portfolio. This move highlights the ongoing trend among institutional investors to adjust their holdings in response to market conditions, which could influence the dynamics of private equity investments.

— Curated by the World Pulse Now AI Editorial System