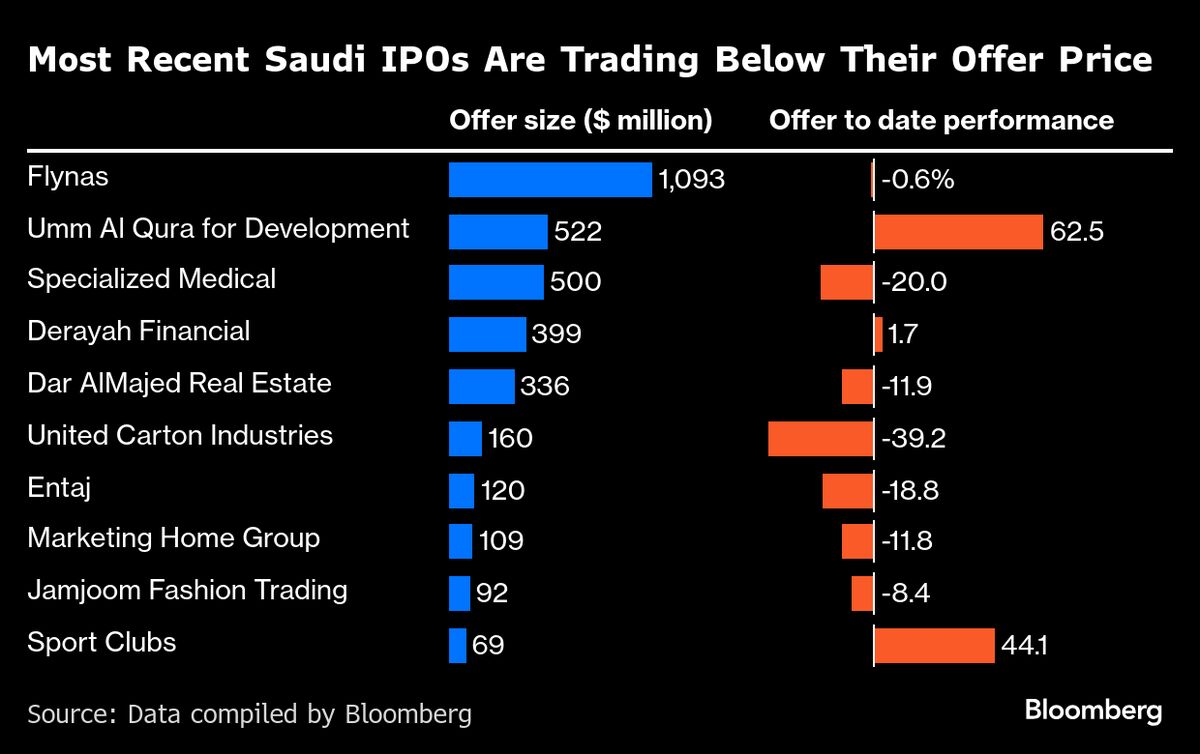

Saudi Wealth Fund Said to Slow Pace of Work on Local Share Sales

NegativeFinancial Markets

Saudi Arabia's sovereign wealth fund is reportedly slowing down its work on several planned share sales, which could have significant implications for the kingdom's ambitious economic transformation efforts. This slowdown may hinder one of the key funding sources needed to support the multitrillion-dollar initiatives aimed at diversifying the economy and reducing reliance on oil revenues.

— Curated by the World Pulse Now AI Editorial System