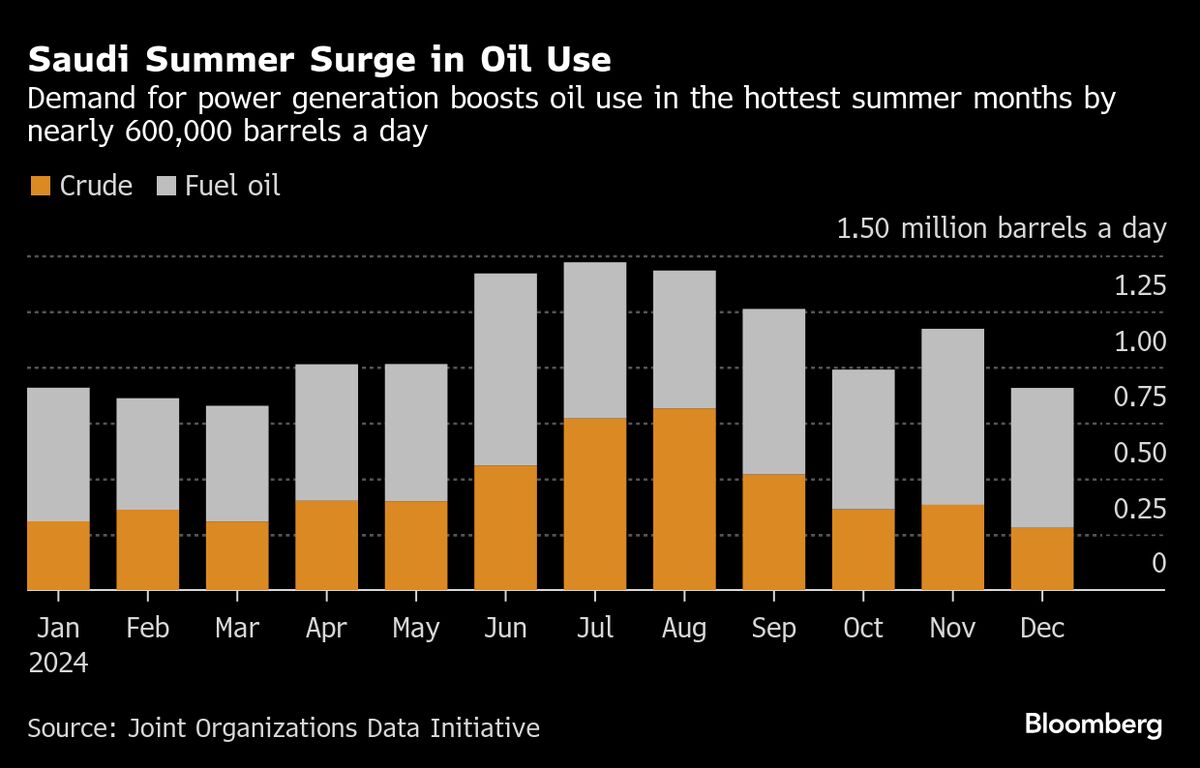

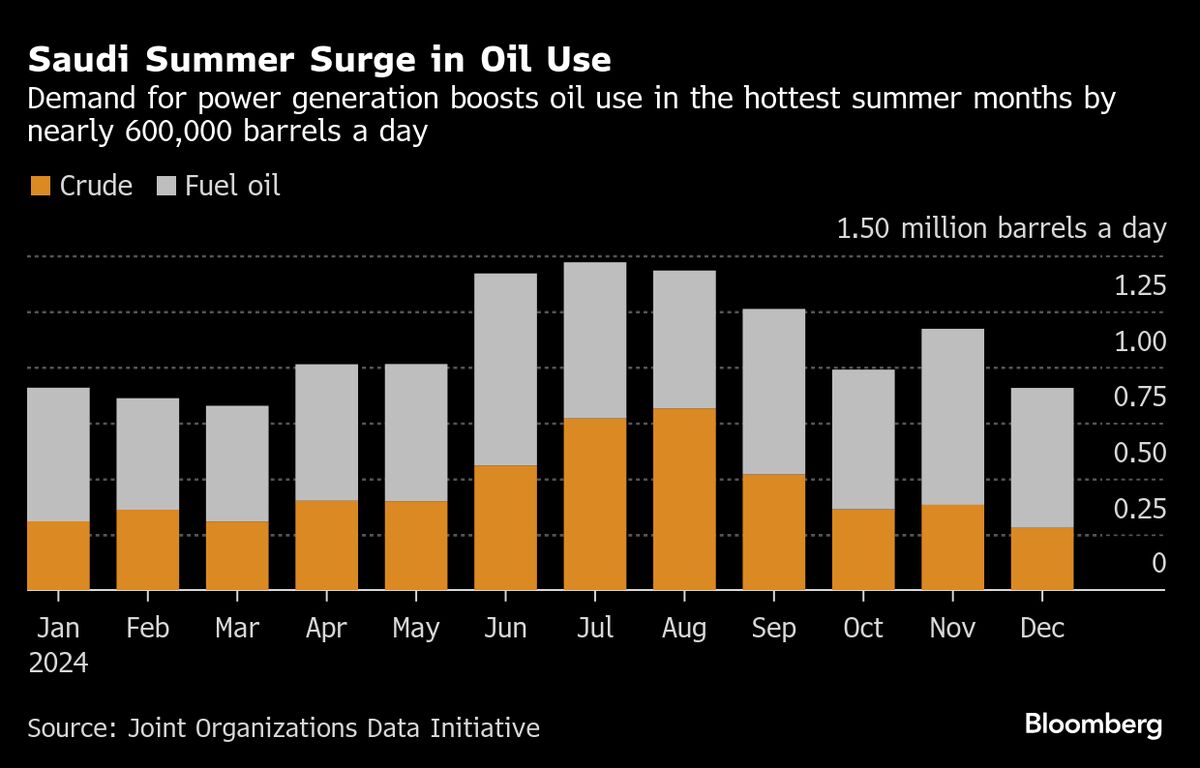

Saudi Crude Shipments Soar as OPEC+ Leader Chases Market Share

Cantor Fitzgerald maintains bullish ratings on Analog Devices and Microchip Technology stocks, signaling tech sector strength, while South Korea's export recovery faces mixed impacts from tech gains and US tariffs.

All major sources, one page

Feel the mood behind headlines

Know what’s trending, globally

Get summaries. Save time

8,561

142

211

14 minutes ago

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

All major sources, one page

Feel the mood behind headlines

Know what’s trending, globally

Get summaries. Save time

8,561

142

211

14 minutes ago

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more