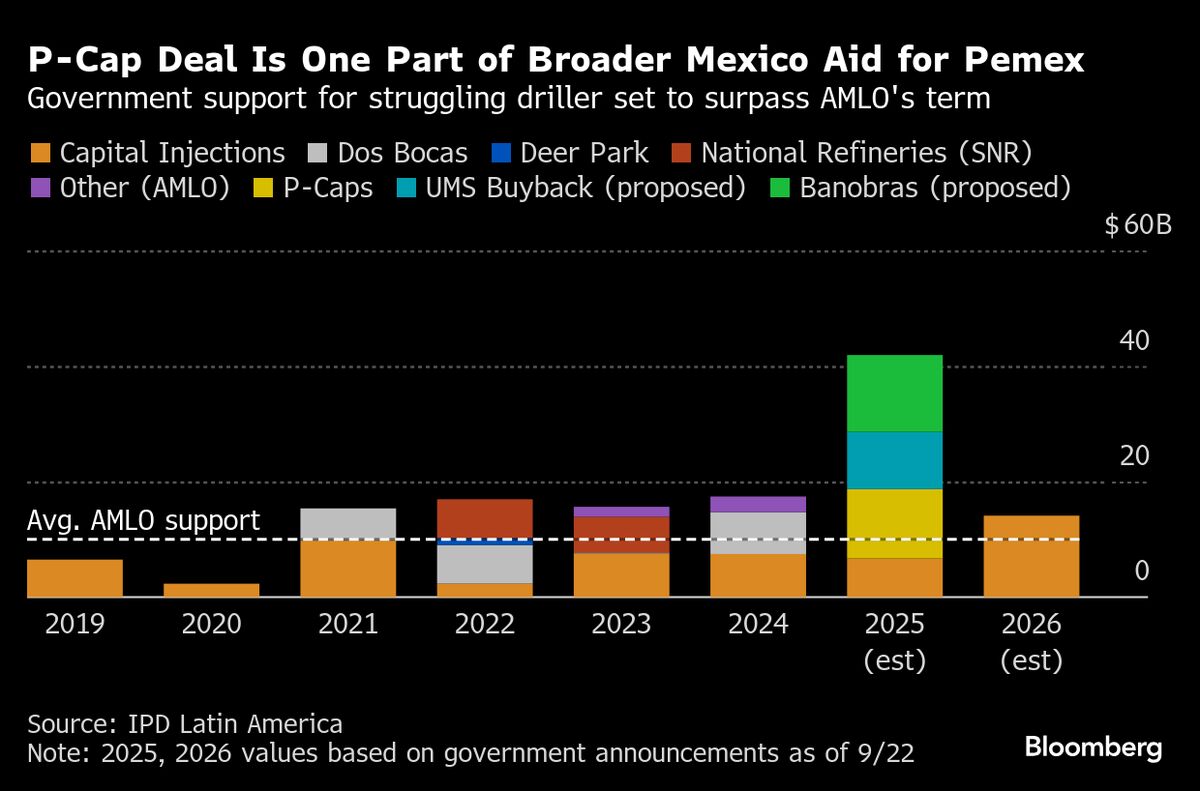

Pemex Is Turning Into One of the Mexican Government’s Heaviest Financial Burdens

NegativeFinancial Markets

Pemex, once a symbol of prosperity for Mexico, is now becoming a significant financial burden for the government. This shift highlights the challenges facing the oil giant, which has struggled with debt and operational inefficiencies. The implications of Pemex's decline are profound, affecting not just the economy but also the livelihoods of many Mexicans who depend on the oil sector.

— Curated by the World Pulse Now AI Editorial System