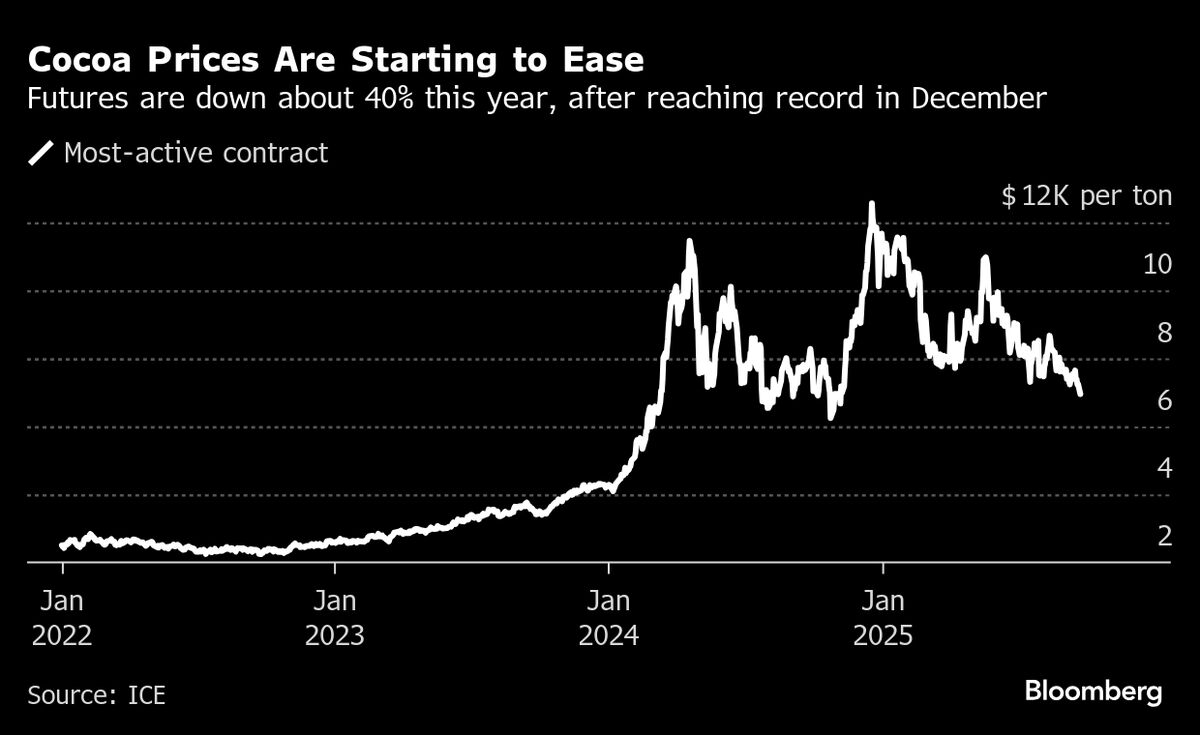

Cocoa’s Historic Crunch Is Easing Further as Harvests Pick Up

PositiveFinancial Markets

The cocoa market is experiencing a positive shift as harvests in South America improve and demand decreases, leading to a projected surplus. This turnaround is significant for producers and consumers alike, as it may stabilize prices and ensure a steady supply of cocoa products in the future.

— Curated by the World Pulse Now AI Editorial System