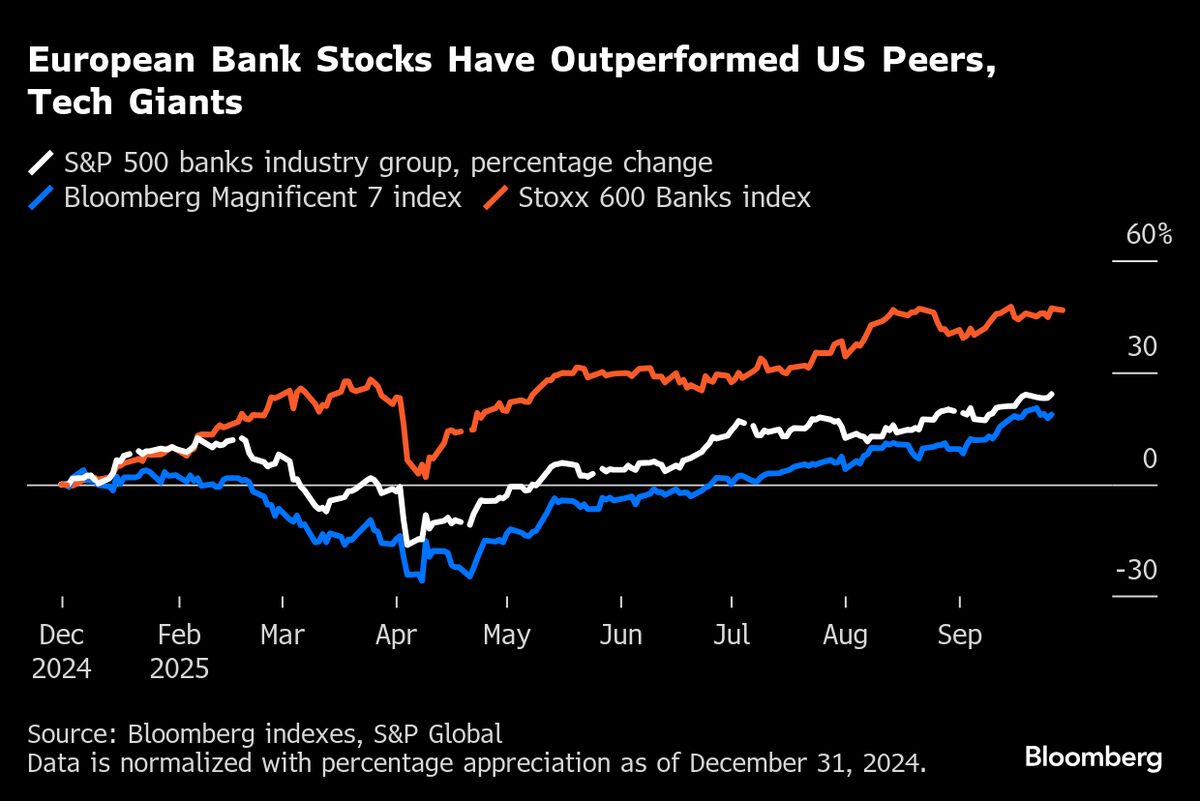

AT1 Bond Market Notches Record Bull Run on Rosy Bank Outlook

PositiveFinancial Markets

The AT1 bond market is experiencing its largest bull run to date, driven by a positive outlook for banks. This surge in risky bank debt reflects investor confidence, even as some worry about potential overheating in the market. This trend is significant as it indicates a strong recovery and optimism in the banking sector, which can have broader implications for financial stability and investment opportunities.

— Curated by the World Pulse Now AI Editorial System