Applied Materials stock falls after export rules expected to cut revenue

NegativeFinancial Markets

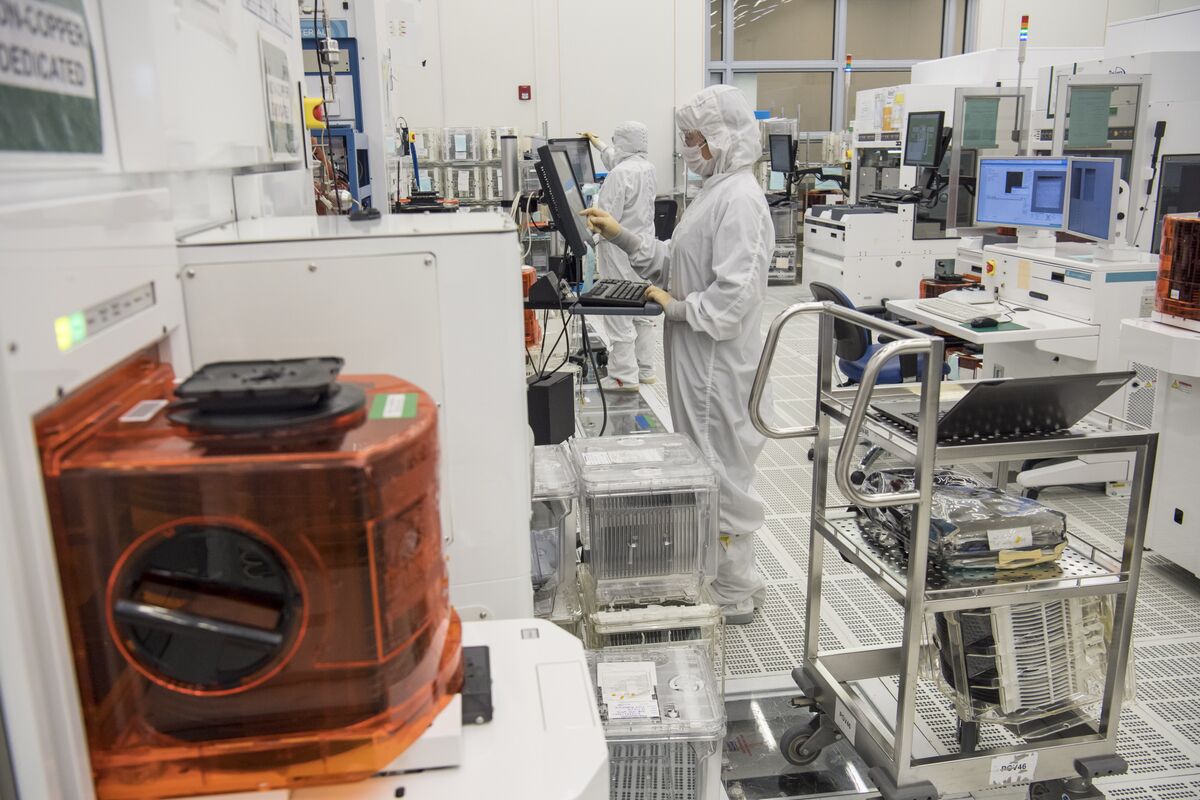

Applied Materials' stock has taken a hit following the announcement of new export rules that are anticipated to significantly reduce the company's revenue. This development is concerning for investors as it raises questions about the company's future profitability and market position. Understanding the implications of these regulations is crucial for stakeholders who are closely monitoring the semiconductor industry.

— Curated by the World Pulse Now AI Editorial System