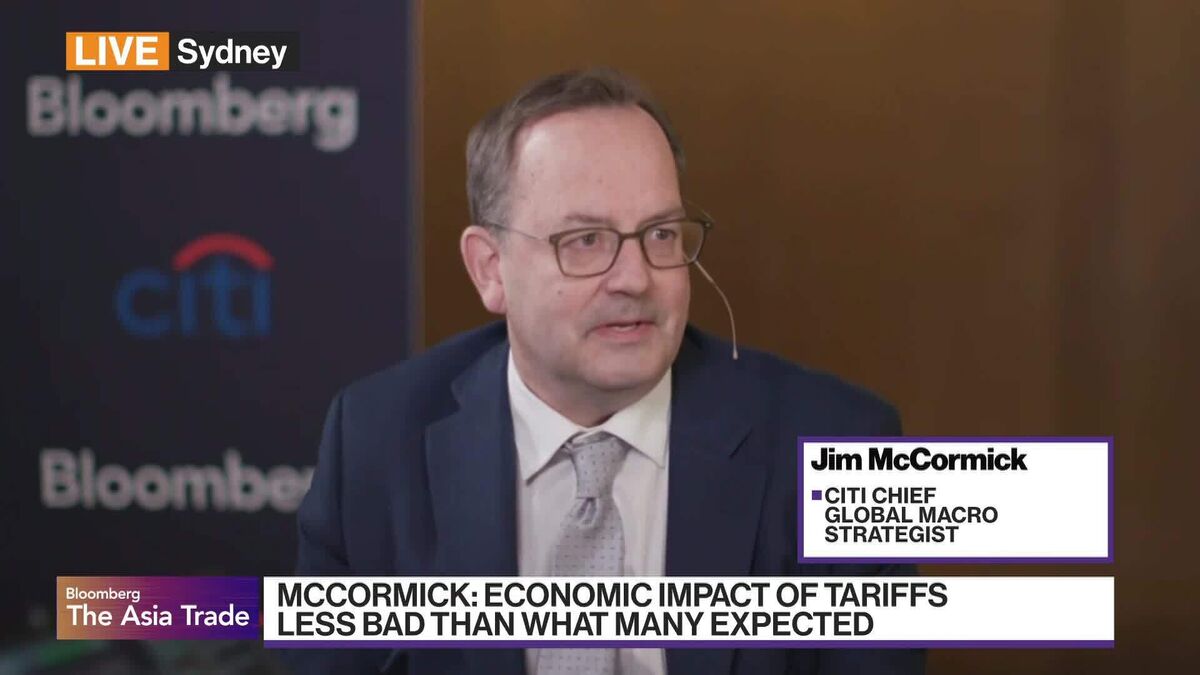

Citi: Volatility Too Low Given Risk of US-China Spat

NegativeFinancial Markets

Jim McCormick, Citi's Chief Global Macro Strategist, highlights a concerning trend in the markets during a discussion at the Citi Australia & New Zealand Investment Conference in Sydney. He argues that the current market volatility is too low given the escalating trade tensions between the US and China. This matters because inadequate pricing of these risks could lead to significant market corrections, affecting investors and the global economy.

— Curated by the World Pulse Now AI Editorial System