Japan’s Plan to Secure Power Supply May Curb Market Liquidity

NegativeFinancial Markets

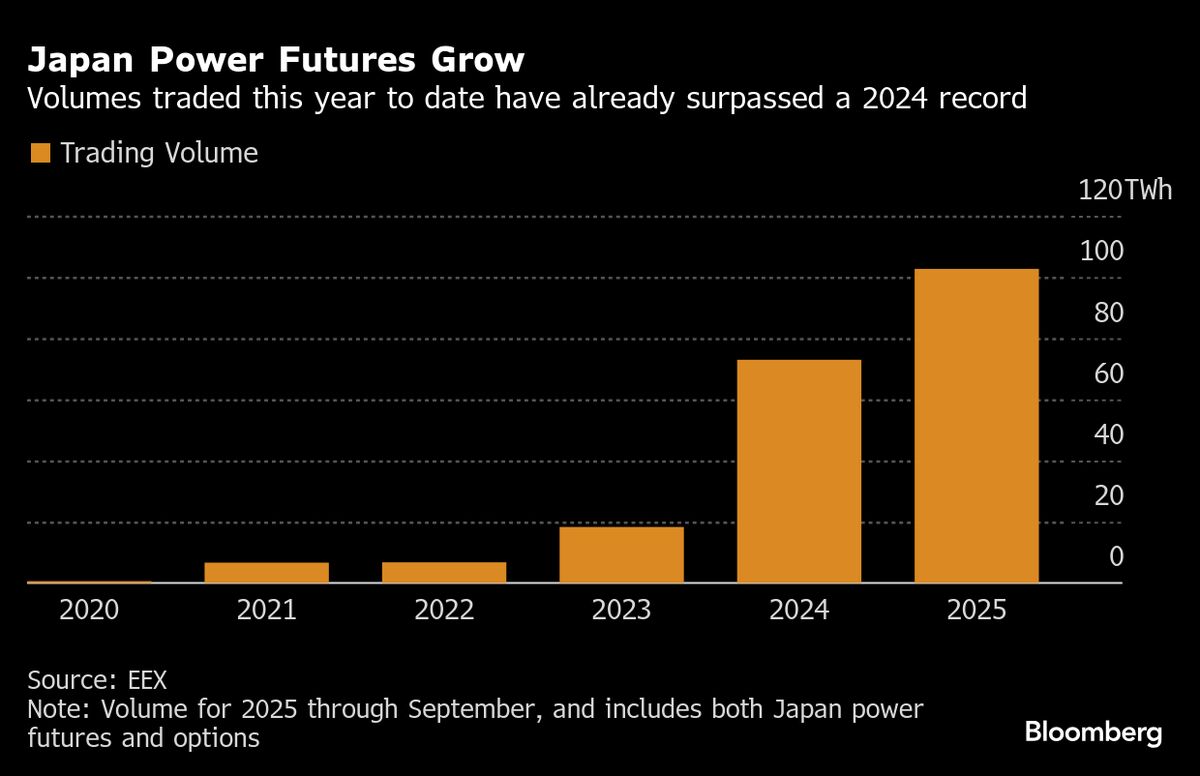

Japan's recent proposals to stabilize electricity supplies could have unintended consequences for market liquidity, raising concerns among traders and officials. As one of the fastest-growing power markets globally, any disruption could affect not just local stakeholders but also international investors looking for opportunities in Japan's energy sector.

— Curated by the World Pulse Now AI Editorial System