Global Markets Rise; U.S. Inflation Data Eyed, Gold, Oil Down

NeutralFinancial Markets

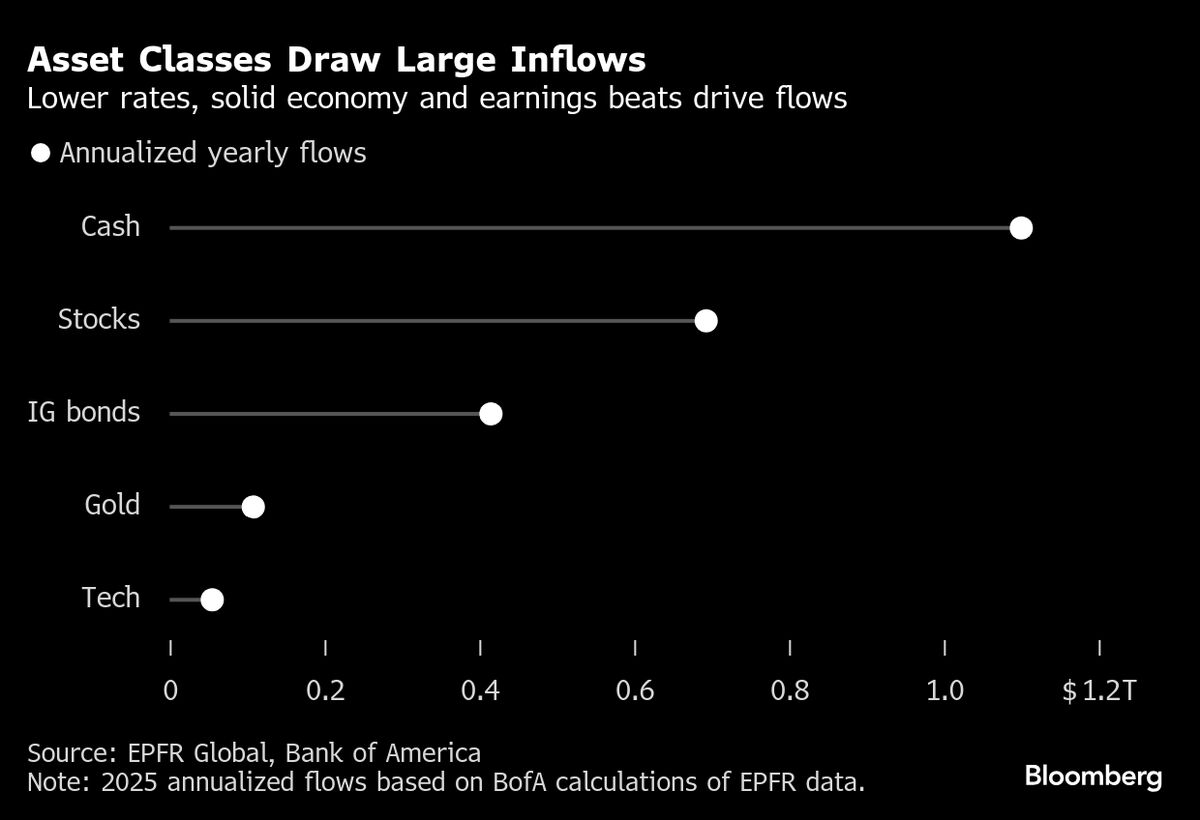

Global markets are experiencing a rise as investors keep a close eye on the upcoming U.S. inflation data for September, which is anticipated to show an increase. This news is significant as it could influence economic policies and market trends. Meanwhile, both gold and oil prices are seeing a decline, reflecting the complex dynamics of the current economic landscape.

— Curated by the World Pulse Now AI Editorial System