Money-Market Stress Persists Ahead of Fed’s Portfolio Pivot

NegativeFinancial Markets

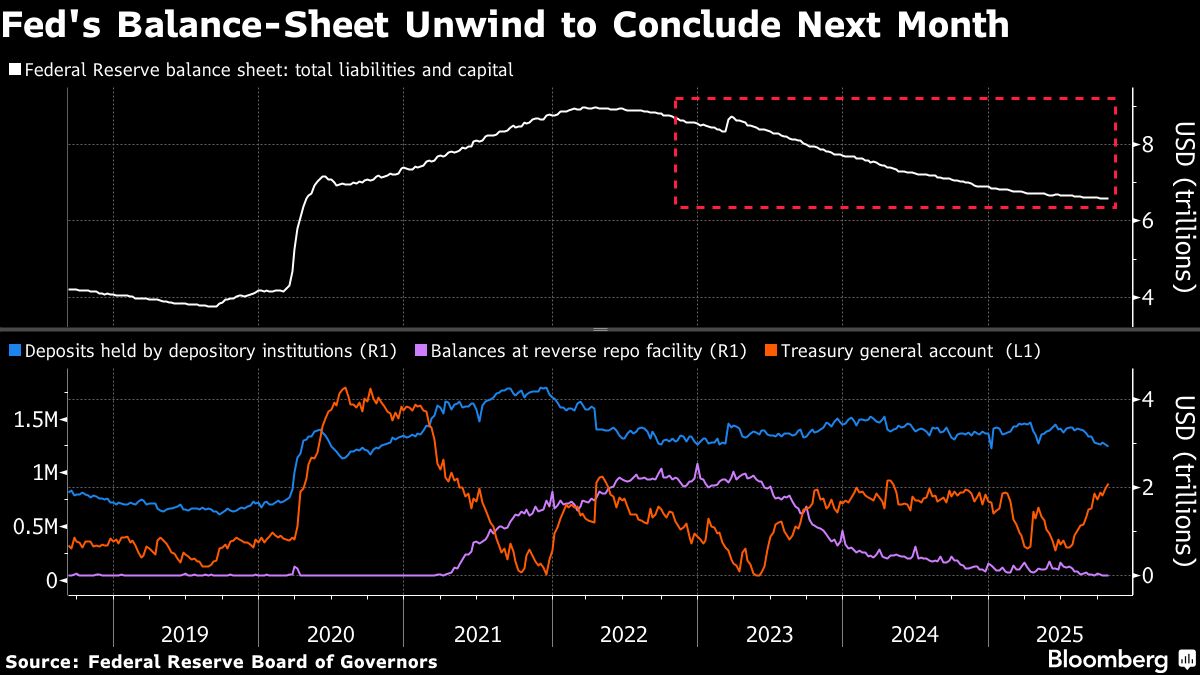

Money-market strains are expected to continue into November as funding costs stay high, which could pressure the Federal Reserve to increase liquidity before it halts its portfolio reduction next month. This situation is significant as it reflects ongoing challenges in the financial system, potentially impacting borrowing costs and economic stability.

— Curated by the World Pulse Now AI Editorial System