Trump Meets Milei, JPMorgan Kicks Off Bank Earnings | Bloomberg Businessweek Daily 10/14/2025

PositiveFinancial Markets

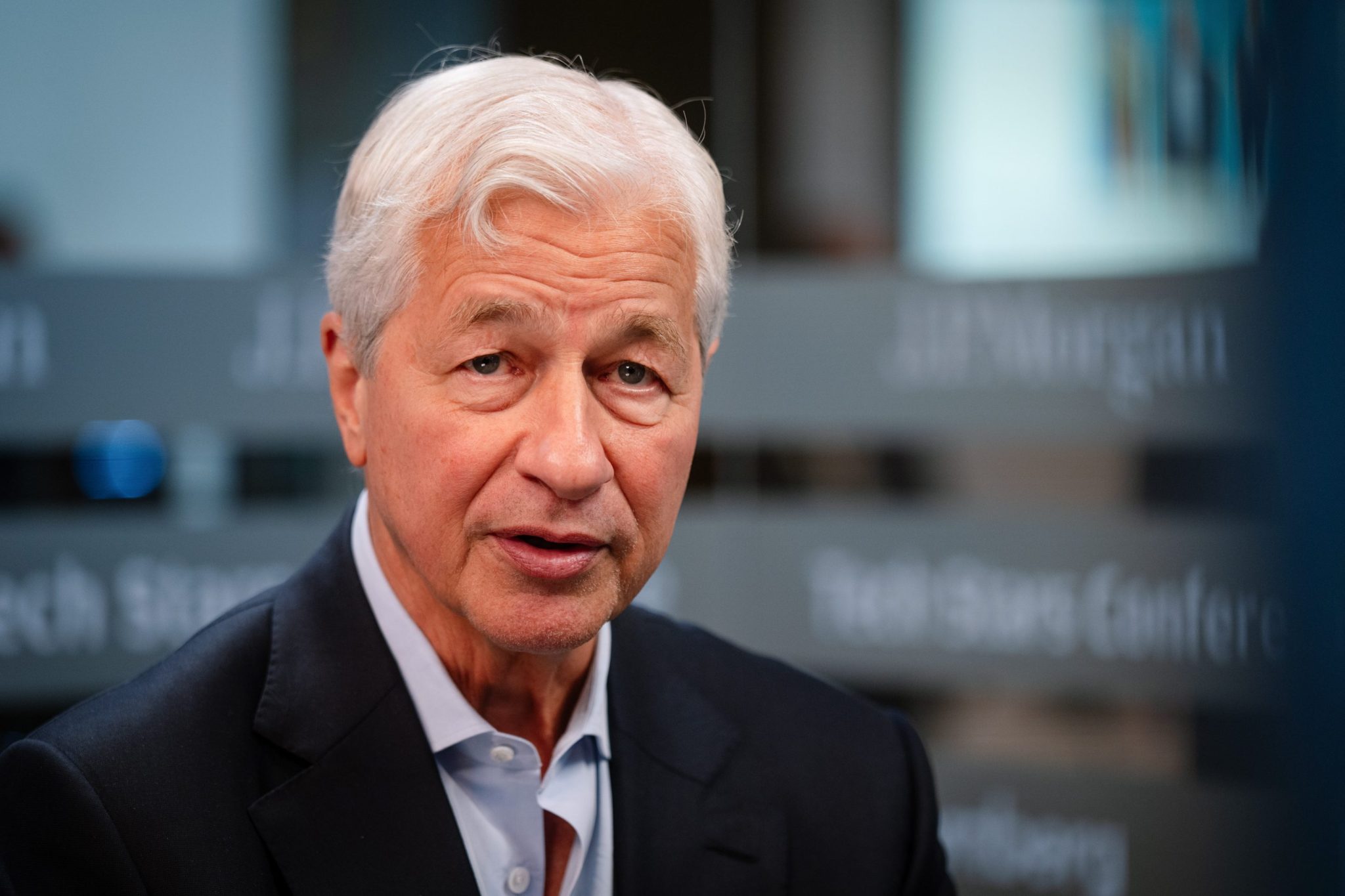

In a significant diplomatic meeting, President Trump welcomed Argentina's President Javier Milei to the White House, signaling potential collaboration between the two nations. This meeting comes at a crucial time as Trump hints at renewed negotiations in US-China trade relations, which could impact global markets. Additionally, the financial sector is buzzing with positive news as JPMorgan and Citigroup report earnings that surpass expectations, indicating a robust banking environment. These developments are important as they not only reflect the state of international relations but also the health of the economy.

— Curated by the World Pulse Now AI Editorial System