How Tim Cook Evaded Disaster at Apple This Year

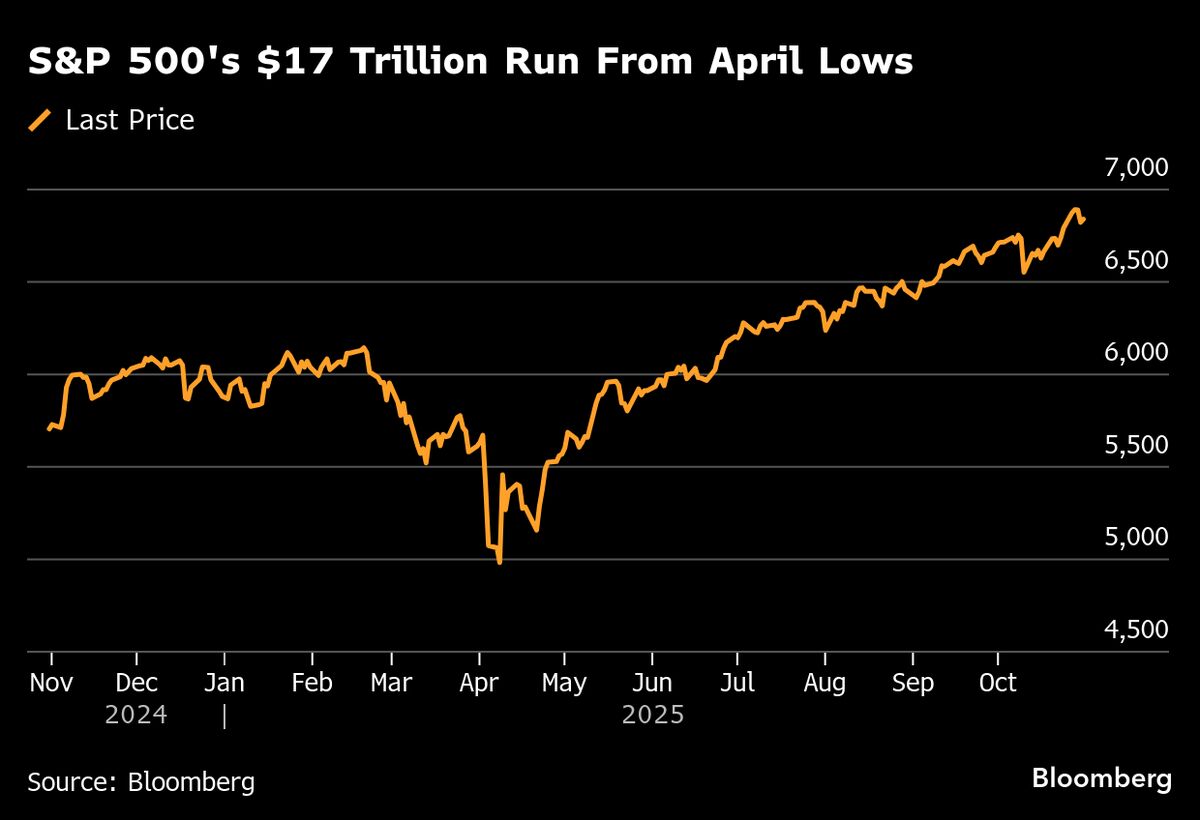

PositiveFinancial Markets

Tim Cook successfully navigated a challenging year for Apple, overcoming risks from Trump's tariffs, ongoing litigation with Google, and the rapid advancements in AI. By leveraging his strategic playbook, Cook has not only steered the company through these obstacles but also boosted its valuation to an impressive $4 trillion. This achievement highlights Cook's leadership and the resilience of Apple in a competitive tech landscape.

— Curated by the World Pulse Now AI Editorial System