BOE Revamps Crisis-Era Tools to Help Tame Repo Volatility

NeutralFinancial Markets

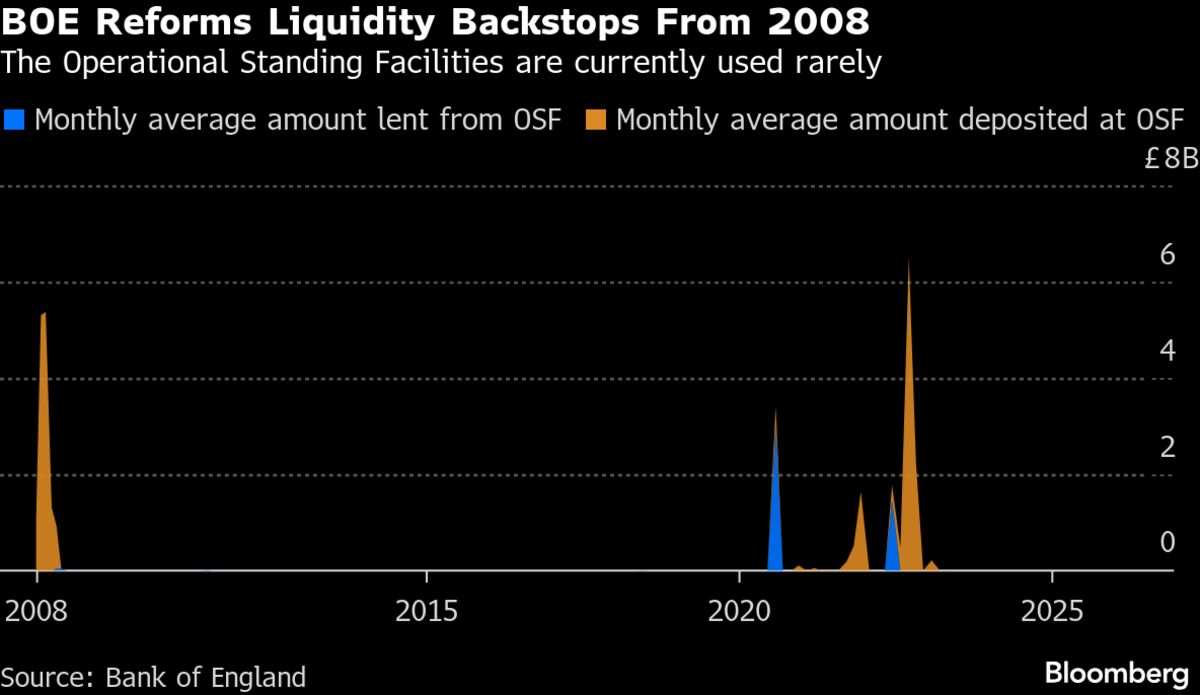

- The Bank of England is revamping its crisis-era lending facilities to enhance their attractiveness to banks, aiming to mitigate increasing volatility in money markets. This initiative reflects the central bank's proactive approach to stabilize financial conditions amidst ongoing economic challenges.

- This development is significant as it seeks to ensure liquidity in the banking system, thereby supporting lending to households and businesses. By making these facilities more appealing, the Bank of England aims to foster confidence among financial institutions during turbulent times.

- The move comes in the context of rising concerns about financial stability, including risks associated with artificial intelligence in lending practices and the impact of hedge fund strategies on market volatility. The Bank's actions highlight a balancing act between stimulating economic growth and addressing potential systemic risks.

— via World Pulse Now AI Editorial System