David Zaslav’s Future Hangs in Balance as Warner Goes Up for Sale

NegativeFinancial Markets

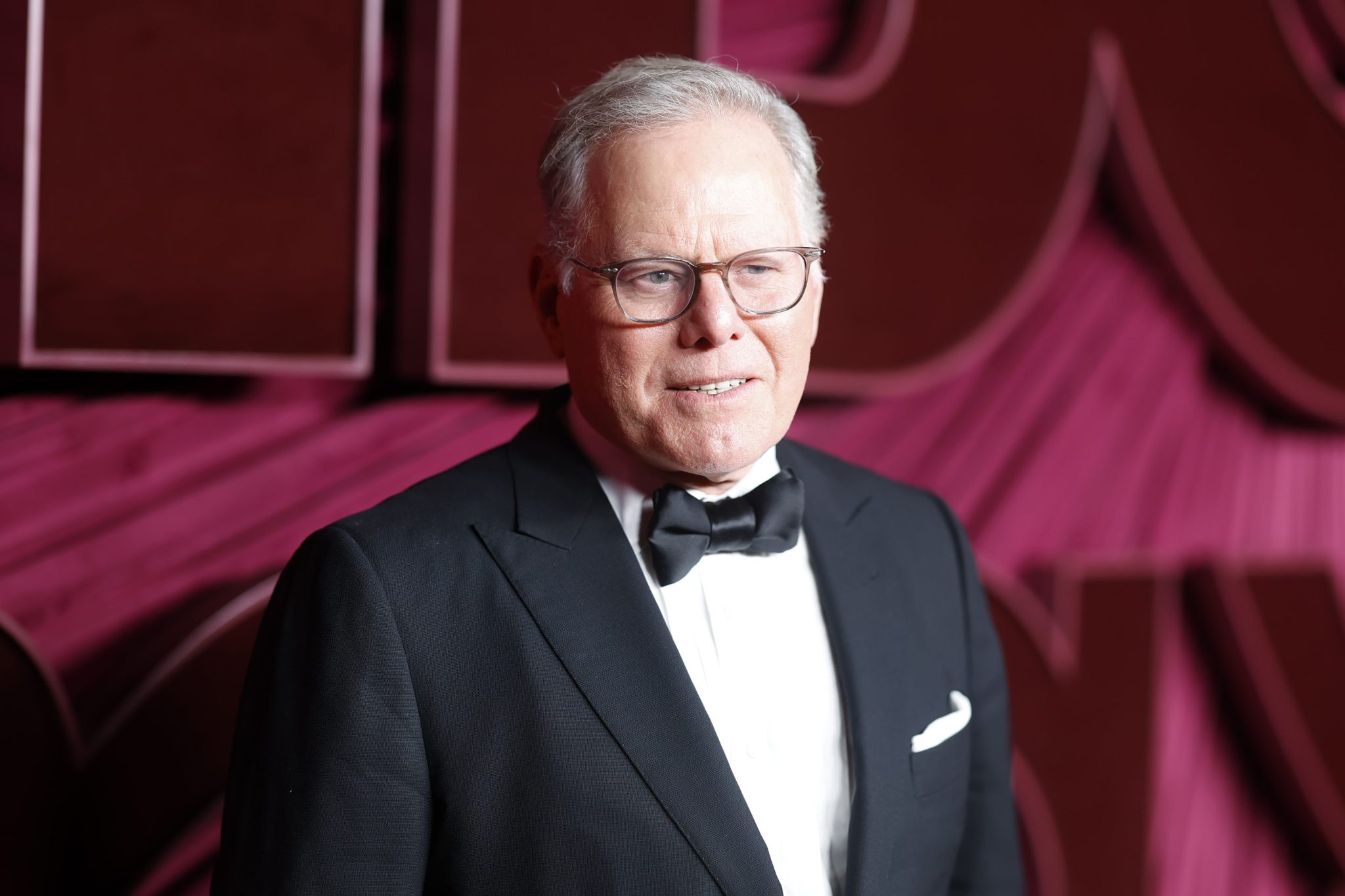

David Zaslav, the CEO of Warner Bros. Discovery, is facing a critical moment as the company is put up for sale, potentially to rival Paramount, led by David Ellison. This situation is significant as it could reshape the entertainment landscape, impacting not only the companies involved but also the broader industry and its workforce.

— Curated by the World Pulse Now AI Editorial System