Division At The Federal Reserve | Real Yield 9/26/2025

NeutralFinancial Markets

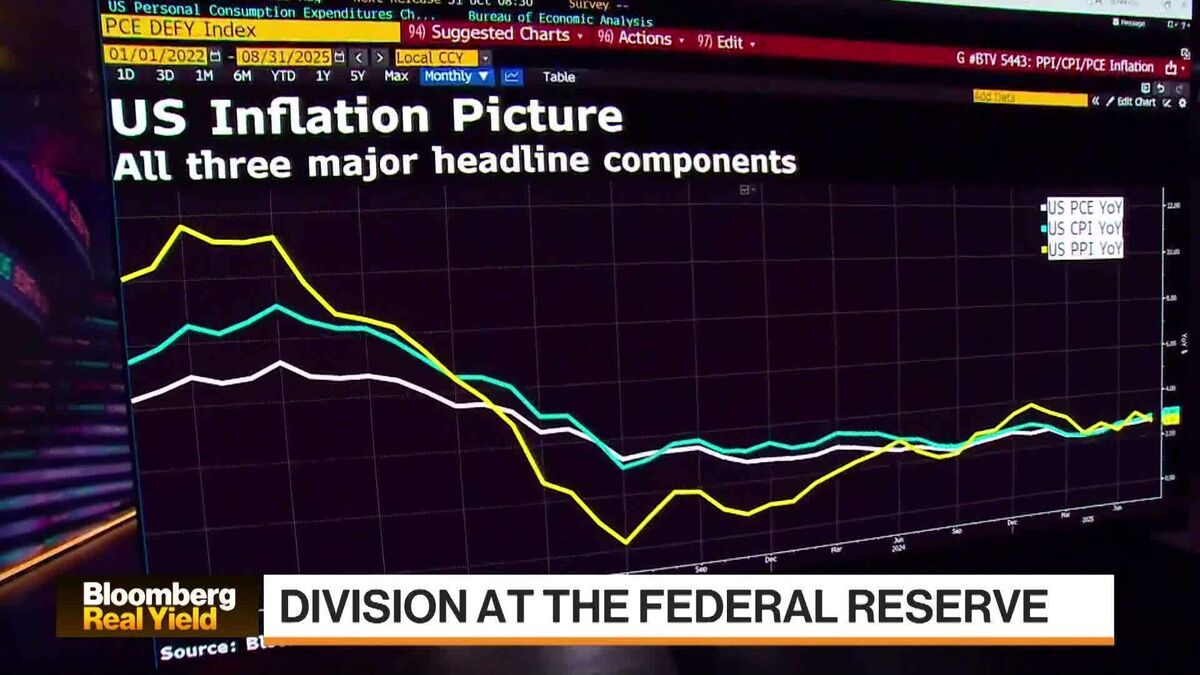

In the latest episode of 'Bloomberg Real Yield,' key figures from the financial sector, including economists and strategists from Wolfe Research, Bank of America, BNP Paribas, and Citi, discuss the current division at the Federal Reserve. This conversation is crucial as it sheds light on differing perspectives within the Fed, which can significantly impact market trends and investor strategies.

— Curated by the World Pulse Now AI Editorial System