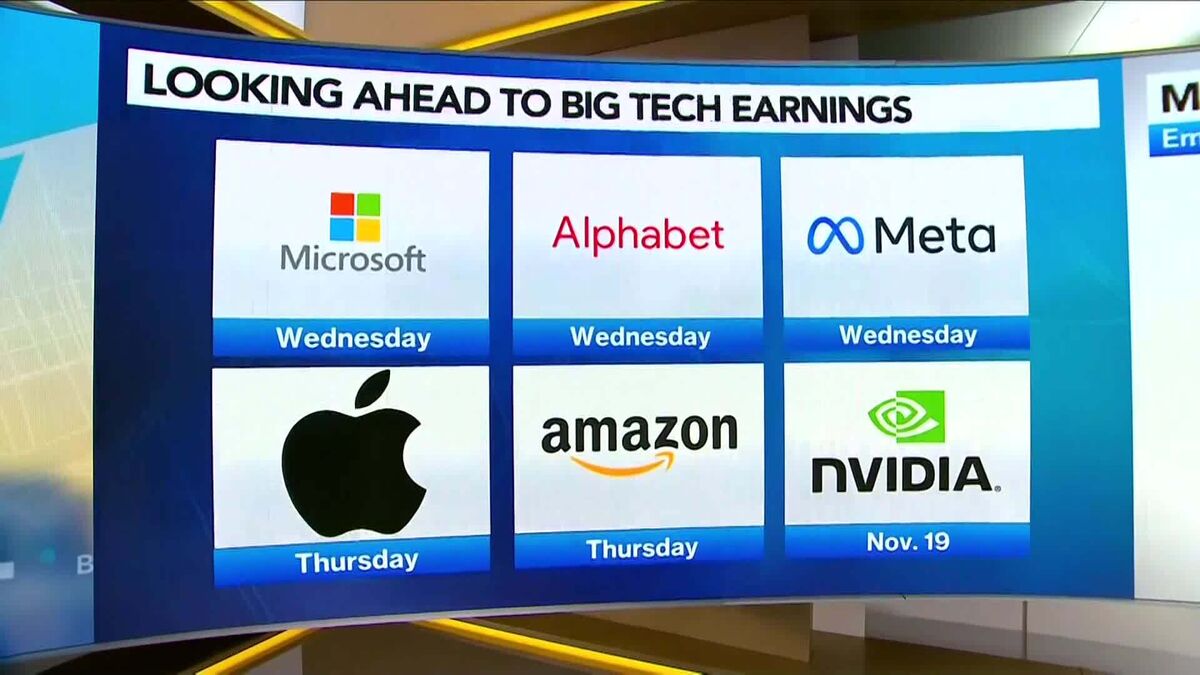

Microsoft stock price target maintained at $650 by DA Davidson on cloud growth

PositiveFinancial Markets

DA Davidson has maintained its stock price target for Microsoft at $650, highlighting the company's strong growth in the cloud sector. This is significant as it reflects confidence in Microsoft's ability to capitalize on the increasing demand for cloud services, which could lead to further investment and growth opportunities for the tech giant.

— Curated by the World Pulse Now AI Editorial System