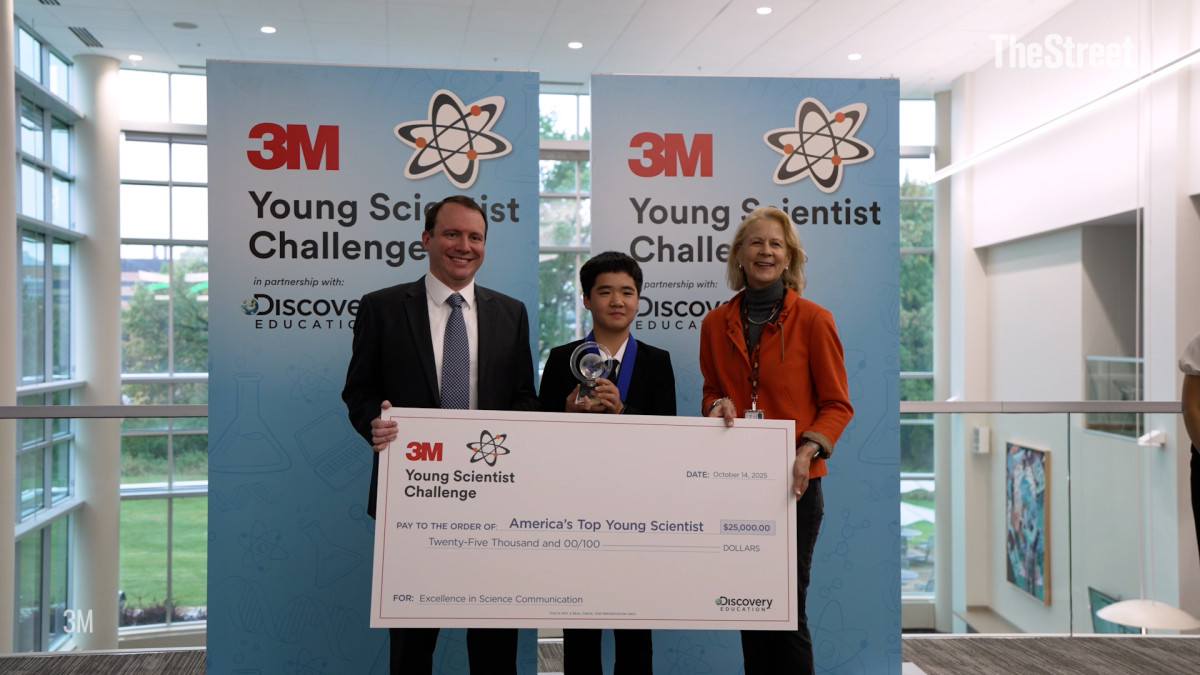

Meet the 2025 3M Top Young Scientist winner

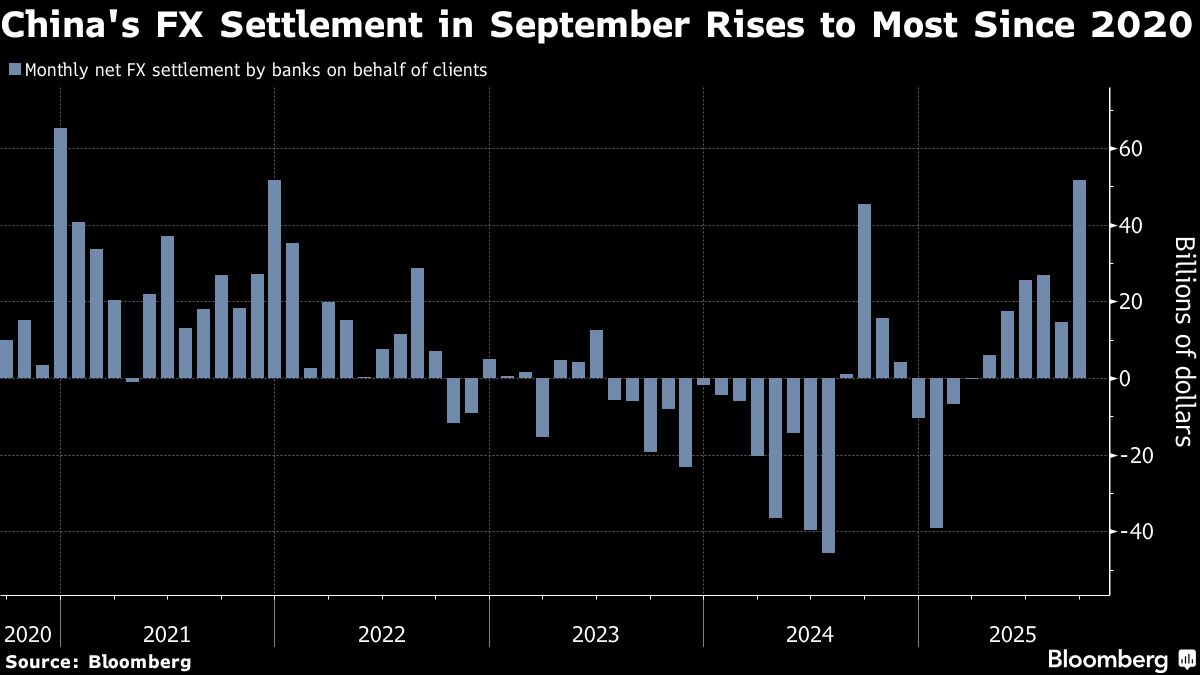

PositiveFinancial Markets

Kevin Tang, the winner of the 2020 3M Young Scientist Challenge, has been recognized as America's top young scientist. This accolade not only highlights his exceptional talent and dedication to science but also inspires other young minds to pursue their passions in STEM fields. Celebrating such achievements is crucial as it encourages innovation and fosters a new generation of thinkers who can tackle the challenges of tomorrow.

— Curated by the World Pulse Now AI Editorial System