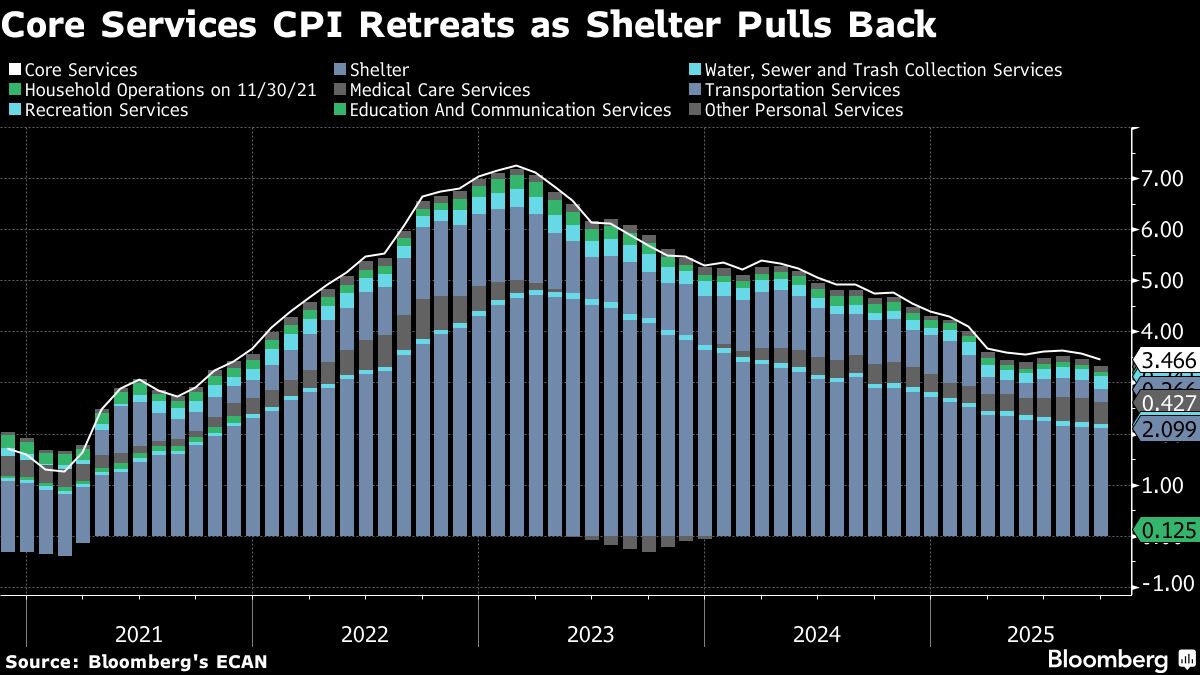

Annual inflation heated up slightly in September, but not as much as economists expected, giving the Fed a clear path for widely expected rate cuts heading into their remaining meetings this year

PositiveFinancial Markets

In September, inflation rose slightly, but not as much as economists had anticipated, which provides the Federal Reserve with a clearer path for the expected rate cuts in their upcoming meetings this year. This is significant as it suggests a more favorable economic environment, potentially easing financial pressures for consumers and businesses alike.

— Curated by the World Pulse Now AI Editorial System