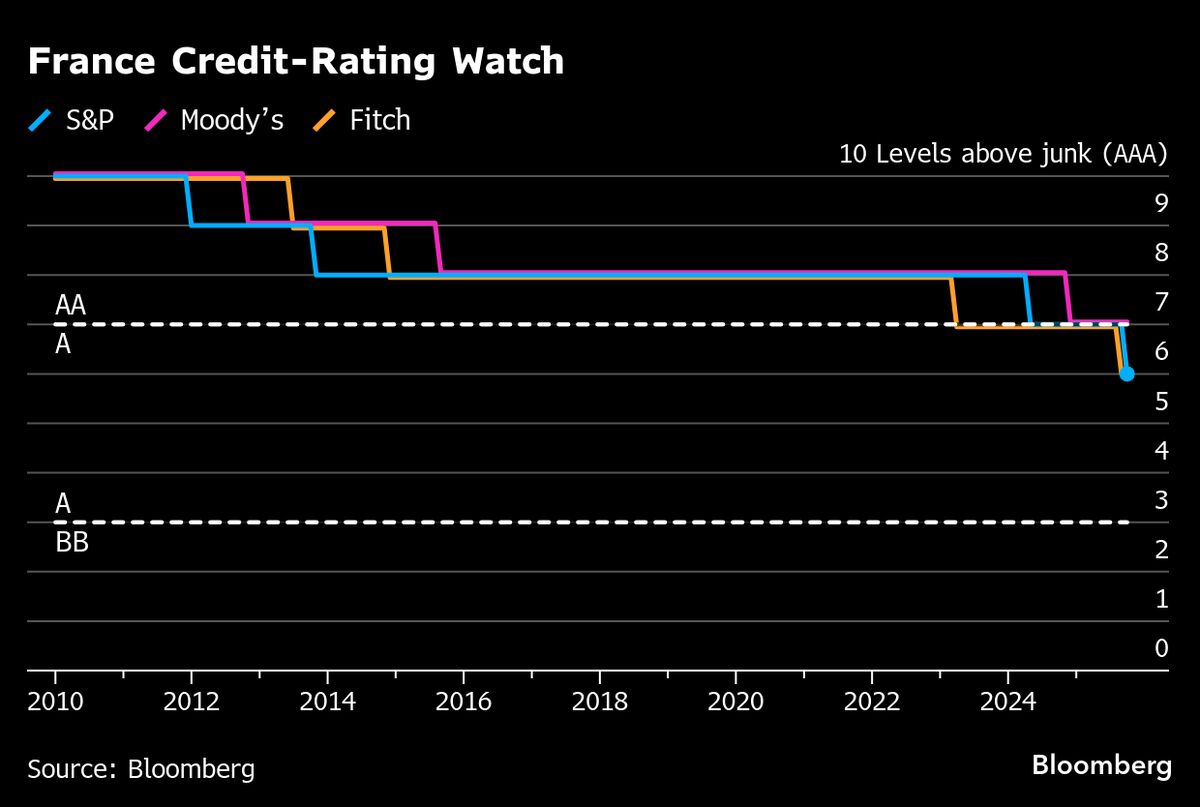

S&P hands crisis-prone France surprise downgrade

NegativeFinancial Markets

In a surprising move, S&P has downgraded France's credit rating, raising concerns about the country's economic stability. This downgrade comes at a time when France is already facing various challenges, including high debt levels and sluggish growth. The implications of this decision could affect investor confidence and lead to higher borrowing costs for the French government, making it a significant development in the European economic landscape.

— Curated by the World Pulse Now AI Editorial System