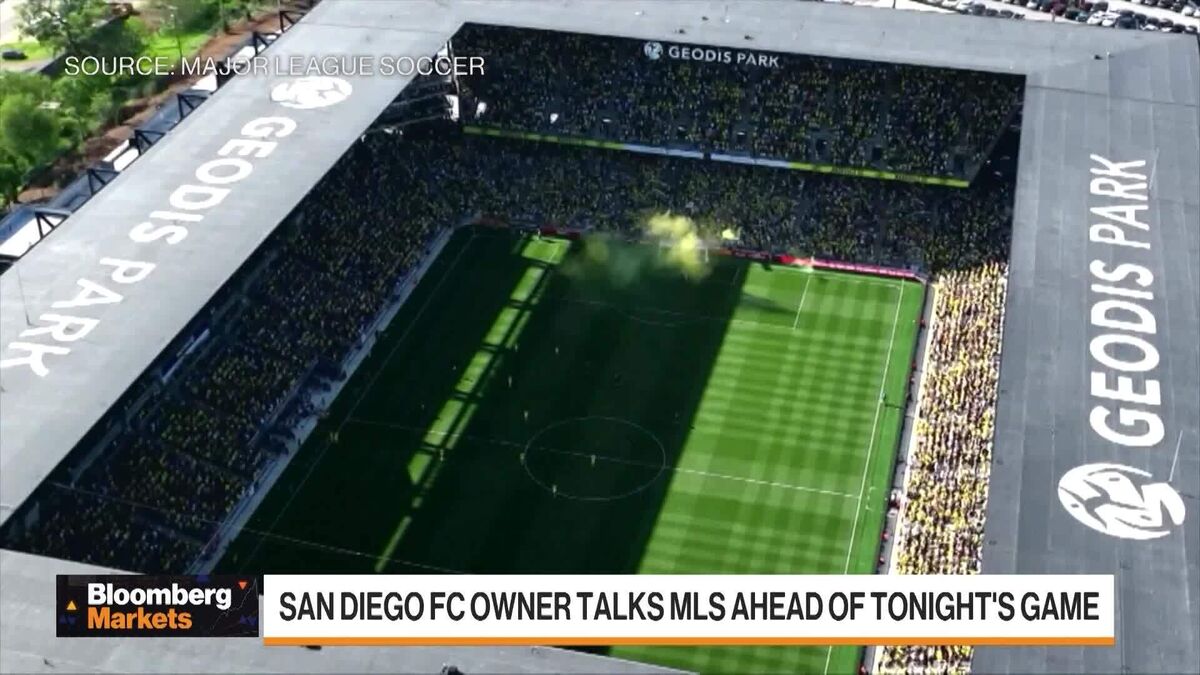

Sports Is An Asset That Will Grow In US: Mansour

PositiveFinancial Markets

- Mohamed Mansour, co-owner of San Diego FC and co-founder of Man Capital, emphasized the potential growth of Major League Soccer (MLS) in the U.S. by aligning its schedule with FIFA's, during an interview on Bloomberg Markets with Scarlet Fu. He noted that the increasing interest in soccer among American fans presents a significant opportunity for the league.

- This development is crucial for Mansour and his investments, as it highlights the long-term value of sports as an asset class. By advocating for a synchronized schedule with FIFA, he aims to enhance the visibility and competitiveness of MLS, which could lead to increased revenues and fan engagement.

- The conversation around sports investment is gaining traction, particularly as prediction markets and other innovative financial instruments become more prevalent. As the U.S. sports landscape evolves, the establishment of more robust trading platforms could further influence investment strategies, reflecting a broader trend of increasing financialization in sports.

— via World Pulse Now AI Editorial System