Warren presses Bessent on Fannie, Freddie IPO efforts in letter

NeutralFinancial Markets

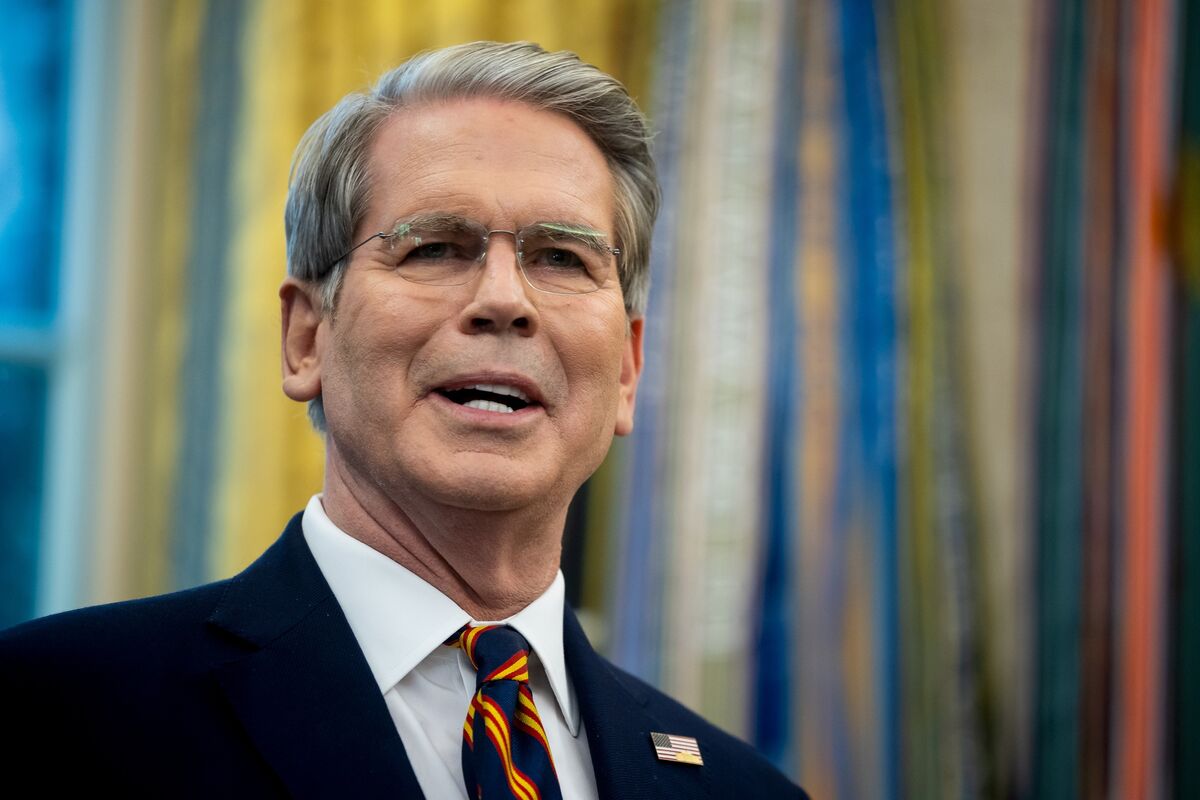

Senator Elizabeth Warren has reached out to Fannie Mae and Freddie Mac's CEO, David Bessent, to inquire about the progress of their initial public offering (IPO) efforts. This communication highlights the ongoing discussions around the future of these government-sponsored enterprises and their potential return to the public market. Understanding the status of the IPO is crucial as it could impact the housing finance system and the broader economy.

— Curated by the World Pulse Now AI Editorial System