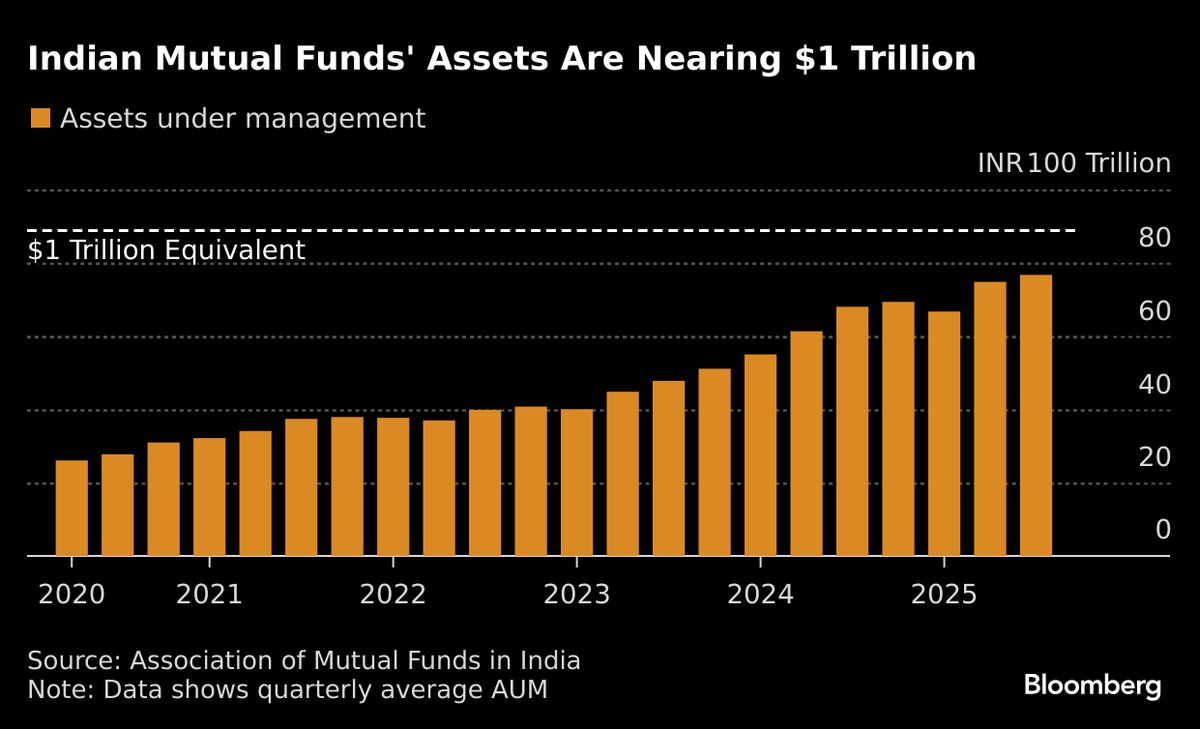

Hedge Fund-Style Products to Reshape $900 Billion Indian Market

PositiveFinancial Markets

A new investment product is set to transform the $900 billion Indian market by introducing hedge fund-style strategies to affluent investors. This innovation is significant as it not only diversifies investment options for wealthy individuals but also enhances the capabilities of asset managers in India, potentially leading to greater financial growth and stability in the market.

— Curated by the World Pulse Now AI Editorial System