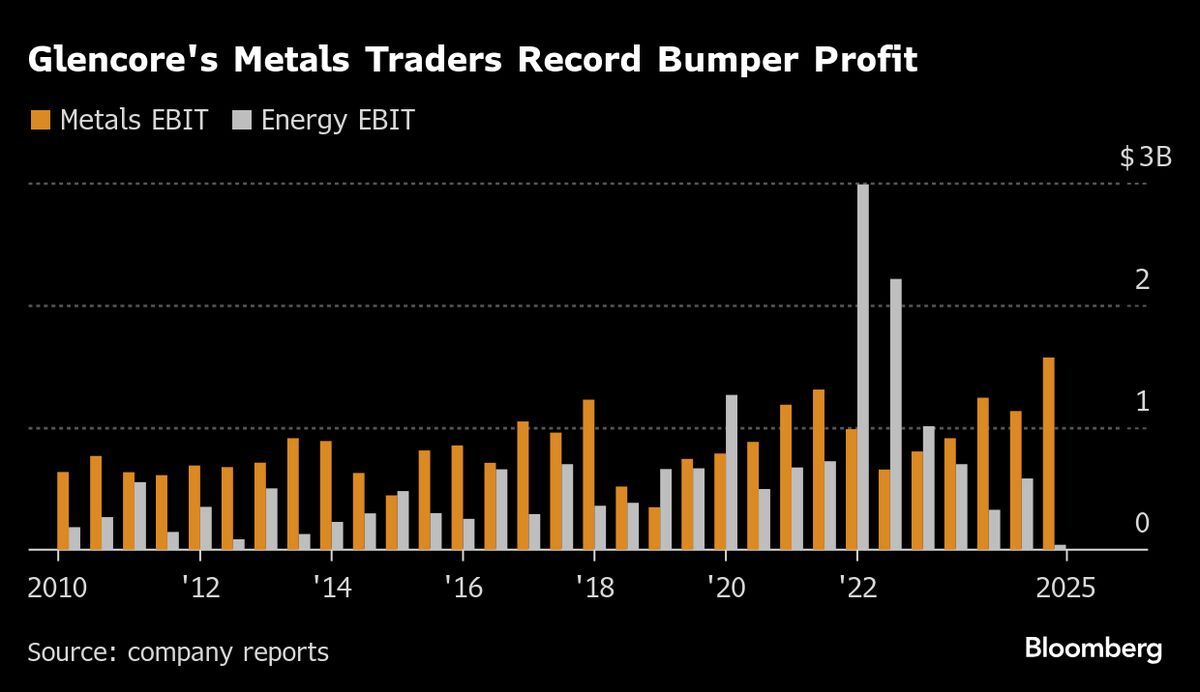

Metals Traders Are Enjoying Their Most Profitable Year on Record

PositiveFinancial Markets

This year has been a remarkable one for metal traders, marking their most profitable period on record. A series of supply upheavals have led to soaring prices, creating significant shifts in the movement of metals worldwide. This surge not only highlights the resilience of the trading industry but also reflects broader economic trends that could impact various sectors. It's an exciting time for traders as they navigate these changes and capitalize on the opportunities presented by the current market dynamics.

— Curated by the World Pulse Now AI Editorial System