Meet Mira Murati, the 36-year-old tech prodigy who shot to fame at OpenAI and now runs a startup that’s a poaching target for Mark Zuckerberg

PositiveFinancial Markets

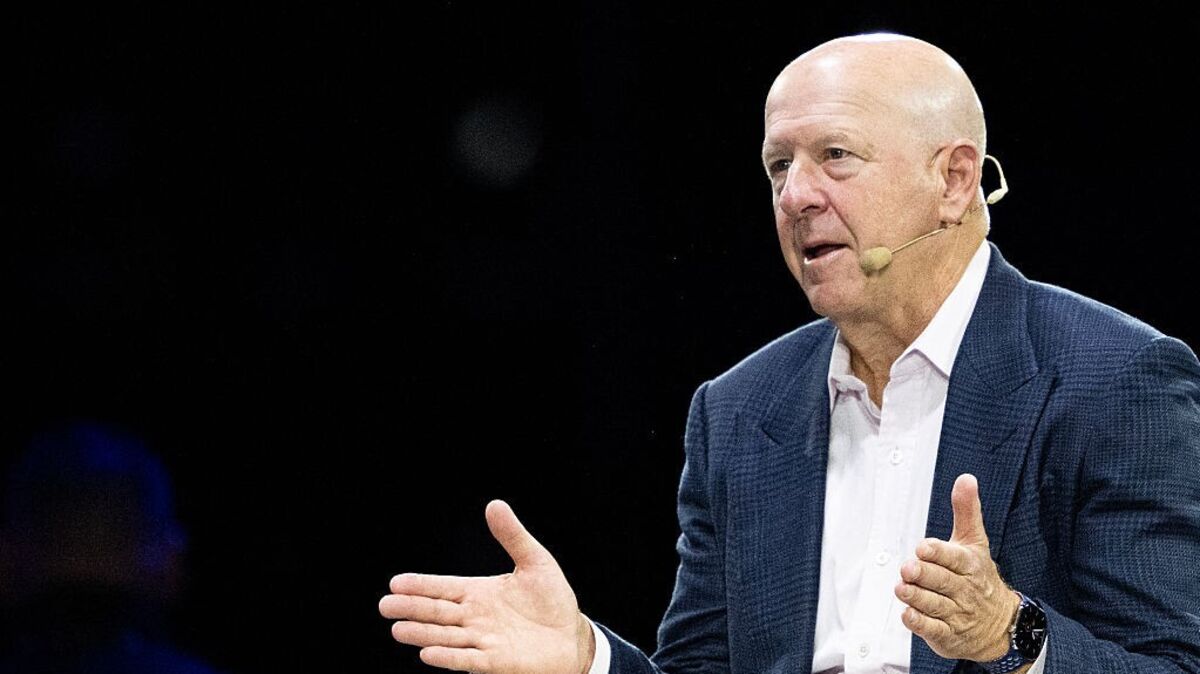

Mira Murati, a 36-year-old tech prodigy, has made waves in the artificial intelligence sector, rising to prominence at OpenAI after impressive stints at Goldman Sachs and Tesla. Now, she leads her own startup, which has caught the attention of tech giant Mark Zuckerberg, highlighting her influence and the potential of her innovations. This matters because it showcases the growing importance of AI in the tech landscape and the competitive nature of the industry, where talent like Murati's is highly sought after.

— Curated by the World Pulse Now AI Editorial System