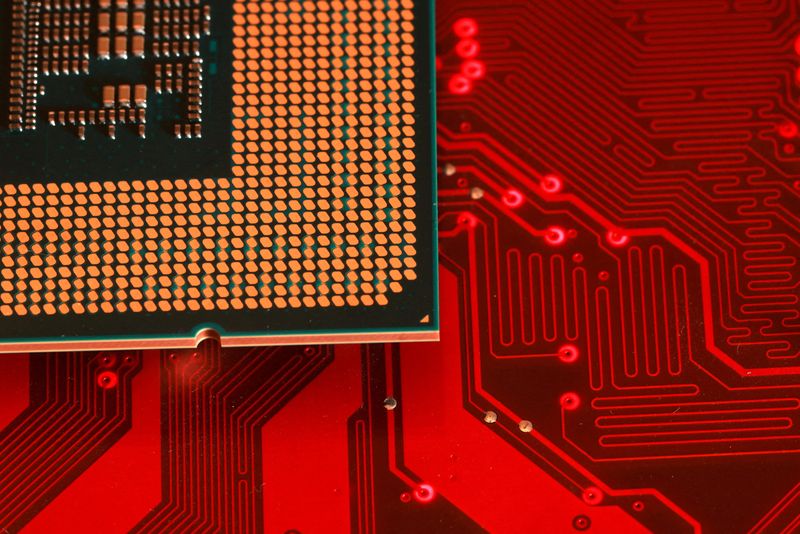

Exclusive-Chipmaker CXMT plans Shanghai listing with $42 billion valuation, sources say

PositiveFinancial Markets

Chipmaker CXMT is making headlines with plans for a listing in Shanghai, aiming for a staggering valuation of $42 billion. This move is significant as it highlights the growing importance of semiconductor companies in the global market, especially amid increasing demand for chips in various industries. Investors are keenly watching this development, as it could set a precedent for other tech firms looking to go public.

— Curated by the World Pulse Now AI Editorial System