US Options Market Grapples With ‘Concentration Risk’ in Clearing

NegativeFinancial Markets

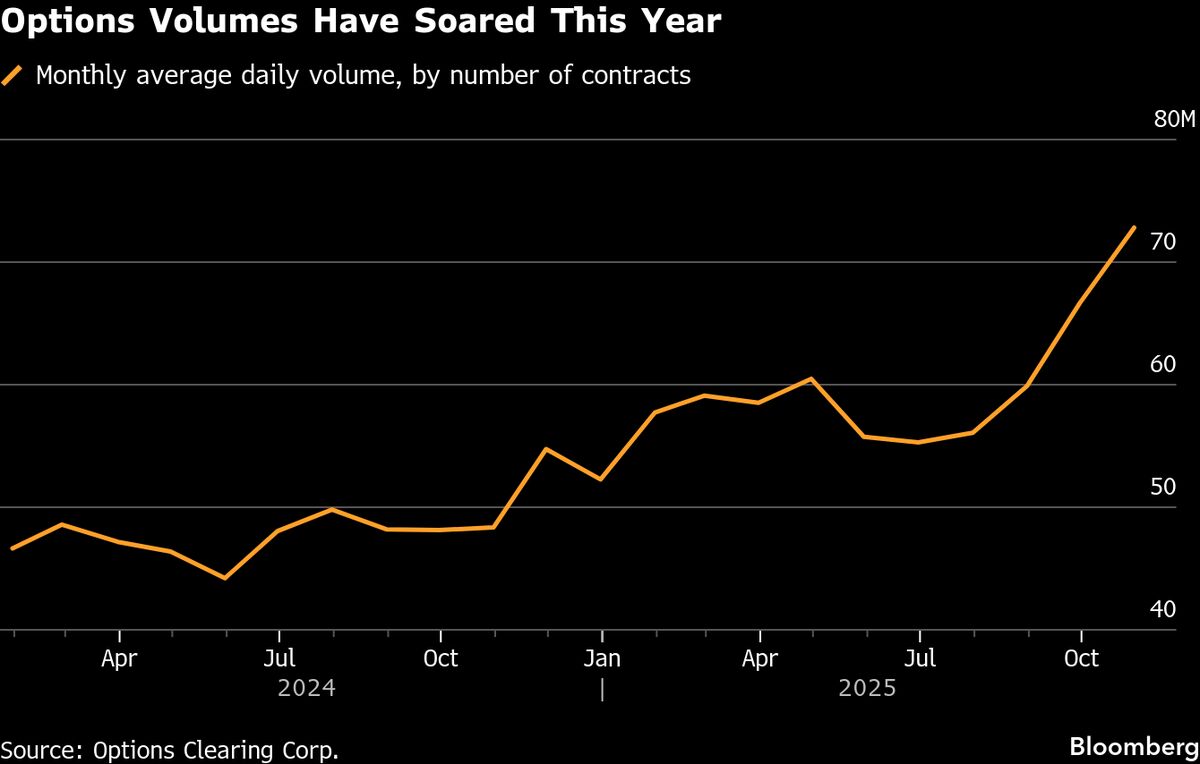

- The US options market is facing heightened concerns regarding 'concentration risk' as it approaches a sixth consecutive year of record trading volume. Industry leaders are increasingly worried about the market's dependence on a limited number of banks to facilitate trades for major market makers, raising alarms about potential vulnerabilities in the system.

- This situation is critical as it underscores the fragility of the options market infrastructure, which could be jeopardized by over-reliance on a few financial institutions. Such concentration may lead to systemic risks that could impact market stability and investor confidence.

- The growing anxiety among traders about market sustainability, particularly following recent volatility, reflects broader uncertainties in the financial landscape. While some sectors show resilience, the options market's challenges highlight ongoing debates about risk management and the need for diversification in financial systems.

— via World Pulse Now AI Editorial System