Bain Is Said to Picks Banks for IPO of Infrastructure Firm Eleda

PositiveFinancial Markets

Bain Is Said to Picks Banks for IPO of Infrastructure Firm Eleda

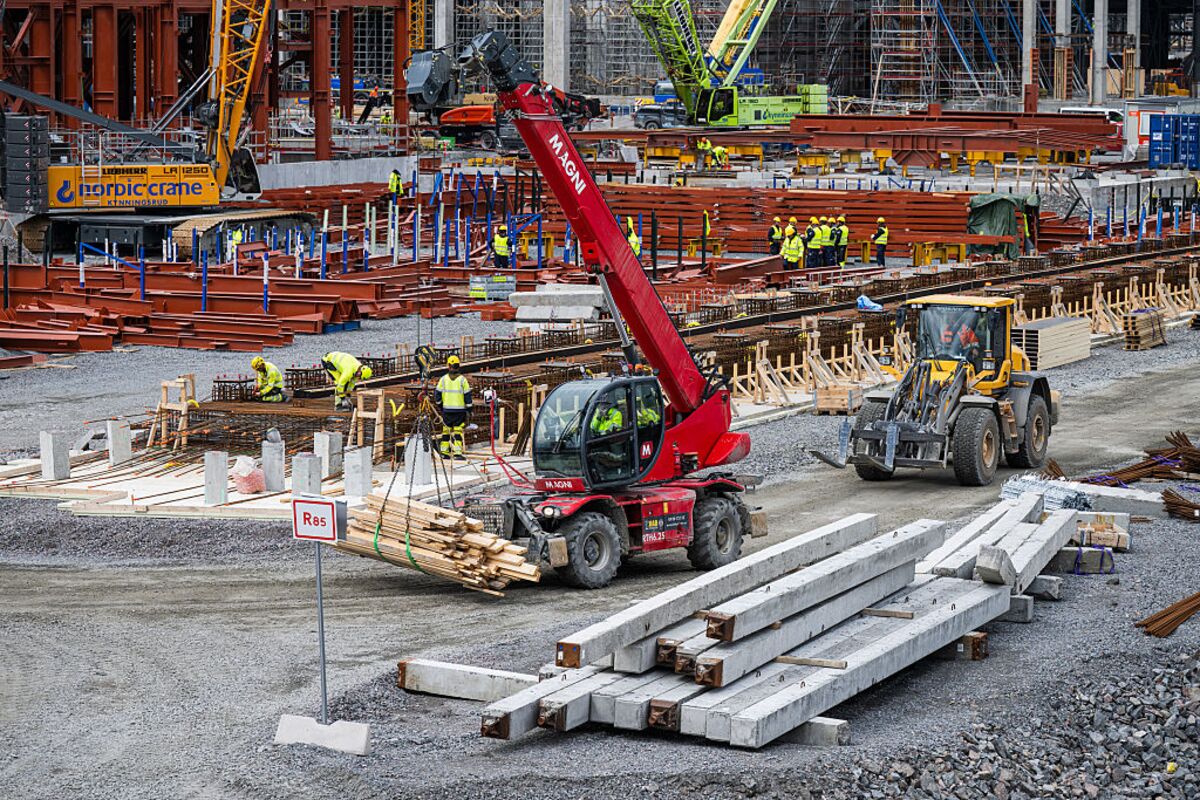

Bain Capital is moving forward with plans for an initial public offering (IPO) of Eleda, a Swedish infrastructure firm. This development is significant as it highlights Bain's confidence in Eleda's potential and the growing interest in infrastructure investments, which are crucial for economic growth and development.

— via World Pulse Now AI Editorial System