Rupee Rout Dims Hopes of a Strong Recovery in Indian Stocks

NegativeFinancial Markets

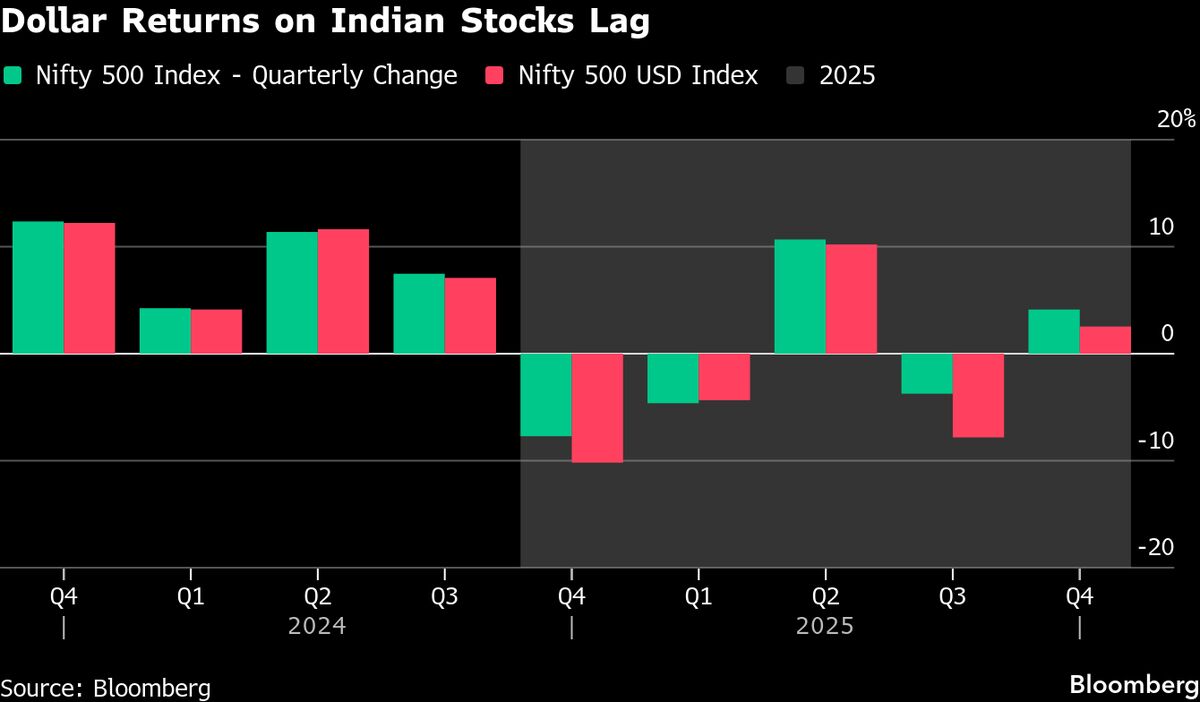

- The Indian rupee has reached new record lows, significantly impacting the equity market as analysts express concerns that this prolonged weakness could hinder the recovery of the $5.2 trillion stock market. The decline in the rupee's value is attributed to various economic factors, including foreign outflows and negative market sentiment.

- This development is critical as it raises questions about investor confidence in the Indian stock market's recovery, which had shown signs of improvement. A weak rupee can lead to increased costs for imports and affect corporate earnings, further complicating the market's recovery trajectory.

- The situation reflects broader economic challenges, including a recent cash crunch in the banking sector, which analysts believe is temporary. Additionally, while some sectors like Indian auto stocks are thriving due to tax cuts, the overall market sentiment remains cautious, highlighting a complex interplay between currency stability and economic growth.

— via World Pulse Now AI Editorial System