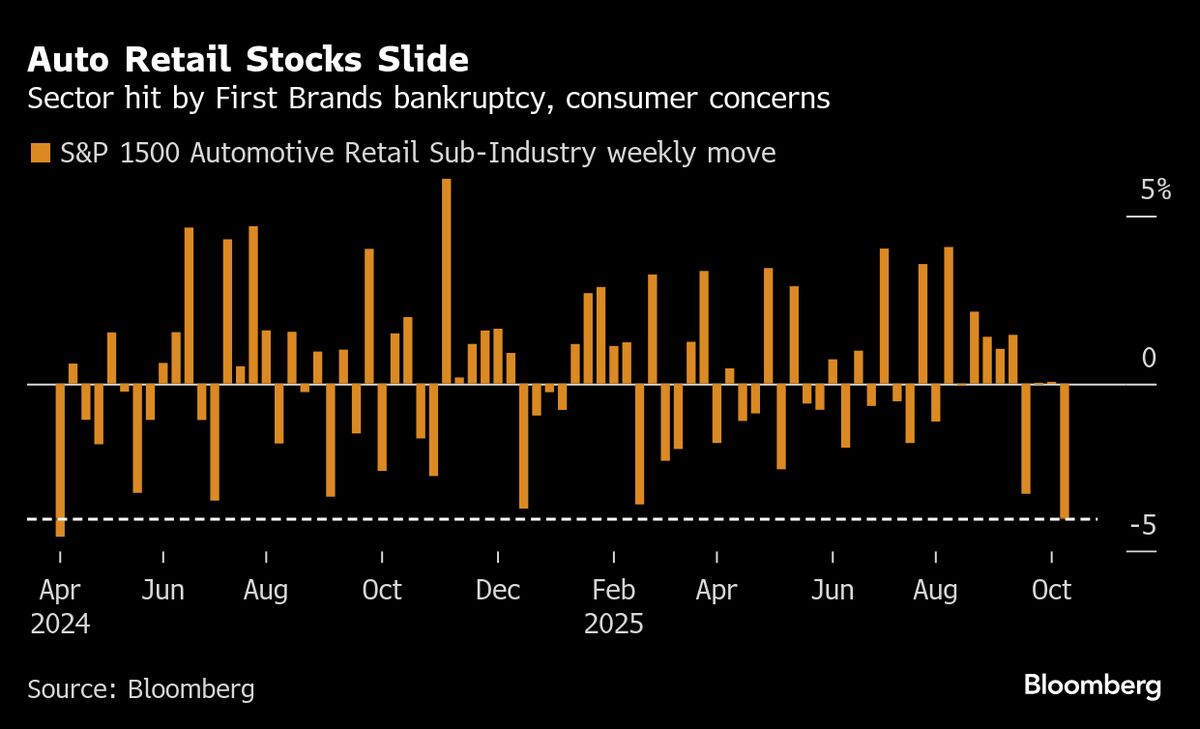

Jefferies expects limited fallout from First Brands’ bankruptcy

NeutralFinancial Markets

Jefferies has assessed that the bankruptcy of First Brands is unlikely to have significant repercussions in the market. This is important as it suggests stability in the sector, indicating that investors and stakeholders may not need to worry about widespread impacts from this event.

— Curated by the World Pulse Now AI Editorial System