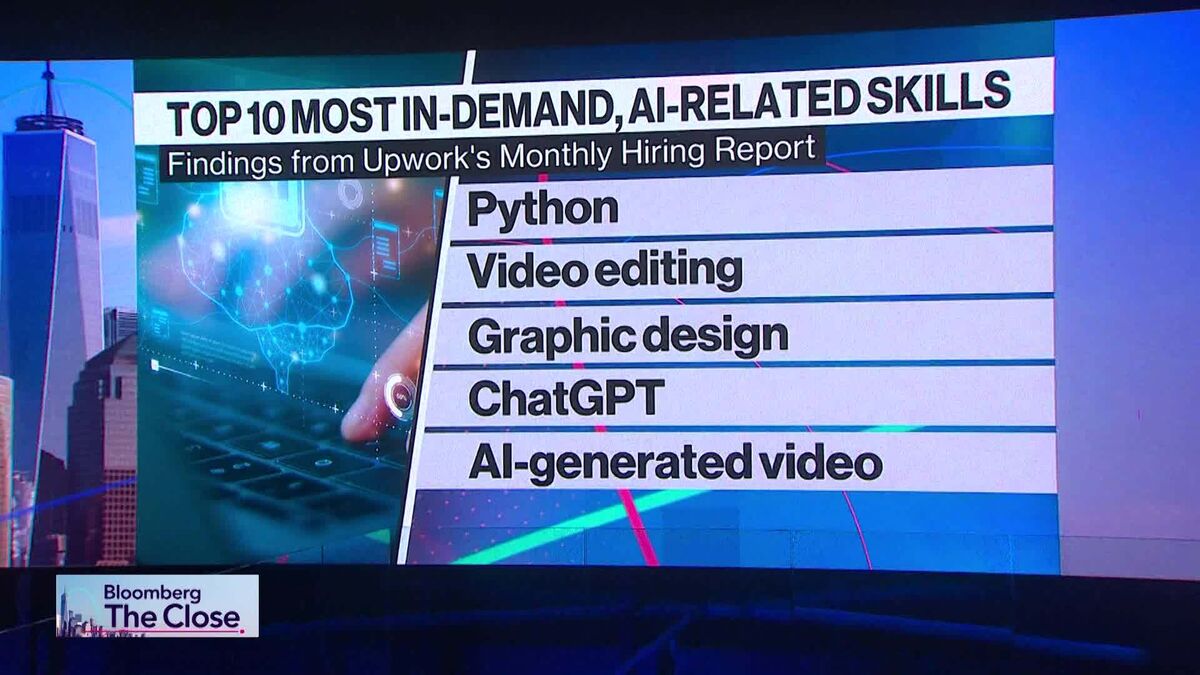

Asian stocks clock weekly gains on rate cut wagers, AI fervour

PositiveFinancial Markets

Asian stocks have shown impressive weekly gains, driven by optimism surrounding potential interest rate cuts and a surge in artificial intelligence investments. This positive momentum reflects growing investor confidence and highlights the market's resilience amid economic uncertainties. As companies continue to innovate in AI, the financial landscape is evolving, making it an exciting time for investors looking to capitalize on these trends.

— Curated by the World Pulse Now AI Editorial System